More Dividends Update from June 2019

June 2019 has proven to be a superb month. That is a very bold statement considering I didn’t make one single stock purchase this month. That’s ok though because I am leaving the month with a lot of good investment ideas and capital that is ready to be deployed.

During the month I did a soft release of the More Dividends – Investment Tracking Spreadsheet. I hope that everyone has been getting a lot of good use out of that. Look for a new version of that to be released soon with some new features including some new Charts&Graphs. If you have downloaded version1.5, I would love to hear your thoughts on it.

Also during the month, I released a feed of other DGI Bloggers articles. Use that page to see all the articles aggregated in the same place. I am still looking for some more good quality blogs to add into the feed so let me know if you have one that you would recommend.

On top of these accomplishments, I also had a record high month for dividend income received. It wasn’t a large increase from my previous best but I still am proud of growing that stream of income. I was also able to publish a record breaking 16 articles during the month which I am hoping provided everyone with a lot of good investments ideas as well as insights into my investing journey. If there is a particular article series that you like I would love to hear about it down in the comments below!

Alright, now let’s take a look at how well the portfolio has done during the month of June!

Stock Additions

No new additions during June but don’t think that I am not itching to make another purchase. I have the gunpowder loaded and ready to pull the trigger.

Dividends Received

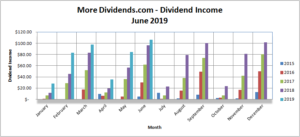

This June actually is a new record for me. It wasn’t a huge gain but it does remind me that the income is steadily growing. I can’t wait to see the number grow even larger!

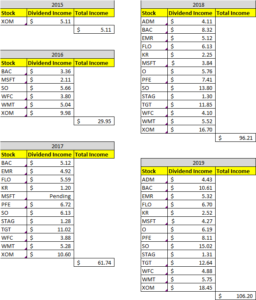

Archer Daniel Midland (ADM) – $4.43 – Reinvested

Bank of America (BAC) – $10.61 – Reinvested

Emerson Electric (EMR) – $5.32 – Reinvested

Flowers Foods (FLO) – $6.70 – Reinvested

Kroger (KR) – $2.52

Microsoft (MSFT) – $4.27 – Reinvested

Realty Income (O) – $6.19 – Reinvested

Pfizer (PF) – $8.11 – Reinvested

Southern Company (SO) – $15.02 – Reinvested

Stag Industrial (STAG) – $1.31

Target (TGT) – $12.64 – Reinvested

Wells Fargo (WFC) – $4.88 – Reinvested

Exxon Mobil (XOM) – $18.45 – Reinvested

June was the last month of Q2 and accounted for $106.20 of my 2019 Dividend Income.

In total during 2019, I earned $434.70 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 10.4% increase in dividends earned during the month of June. I think that there wasn’t a bigger year over year growth because a lot of my purchases over the past year and a half pay their dividends in the 1st or 2nd month of the quarter. If you have been around for awhile, you may remember back in 2016 I posted an article called “When Do I Want My Dividends Paid“. In that article I talked about how I didn’t care when the dividends were paid since I am still in the accumulating stage. This still stands true today! Let’s take a look at those year over year comparisons.

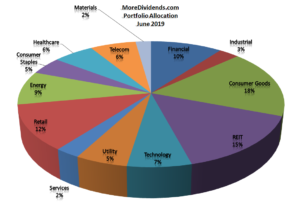

Portfolio Allocation

Since there was no new additions to the More Dividends portfolio during the month, all changes in the allocation can be attributed to fluctuations in the stock market.

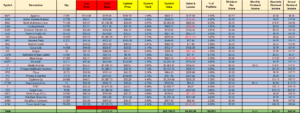

Current Portfolio

Reinvested dividends did all of the lifting for me this month. With no new purchases the DRIPs and market fluctuations made all the changes in the portfolio for me. Hopefully I will be able to report a new purchases to everyone very soon!

MoreDividends.com Articles

Here are the 16 articles that I posted on MoreDividends.com during June from oldest to newest.

Another Recent Buy – Altria Group (MO)

More Dividends Update from May 2019

Setting Up Twitter Cards For DGI Bloggers

What happens to my stock in an ESPP if I quit?

New Additions to DGI Bloggers Passive Income Portfolios!

Ways To Earn A Little Extra Income

Realty Income Increases Dividend 0.2%

Target Increases Dividend by 3.1%

Additions to DGI Bloggers Passive Income Portfolios!

How I’m preparing for the next recession!

Passion FIRE for the Win!!!

Dividend Basics

3 Large Cap Stocks With High Yields and Low PE Ratios

Kroger Increases Their Dividend by 14.3%

WestRock Vs. International Paper

Recent Stock Buys By DGI Bloggers

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

The days of More Dividends being on autopilot are over. Even during months like this where I don’t make any purchases look for a lot of new content coming your way. This month I released the More Dividends – Investment Tracking Spreadsheet and the feed of other DGI Bloggers articles. Both of these can be very useful tools to help you find your investments as well as to keep track of them.

The month saw me breaking a couple of my own records including my dividend income and articles published in a single month. I want to keep bringing you new articles that are filled with analysis and stock ideas. If you have an idea for an article that you would like to see here, I would love to hear about it and I will make it happen!

With free capital ready to be deployed look for some new purchase articles coming your way soon! I will also be releasing a couple of new article series soon that I think will be very interesting to read.

I don’t know about you but I am very excited for what the future holds for More Dividends. It is a very exciting time and I hope that you stick around for the ride because I enjoy all of the interaction that I get from every single one of you and I hope that we can continue to build our relationships stronger in the future!

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Congrats MoreDividends! You had a great month of accomplishments! Great work on your spreadsheets. I have actually been looking for something to track my dividends by month and quarter like your 2nd spreadsheet. It looks great and will definitely try it out! Thanks so much for sharing! It is nice to see you had a record month too! Keep it up! 🙂

My Dividend Dynasty recently posted…June 2019 Dividend Income Plus Recent Buy – Starwood Property Trust (STWD)

Thank you for your kind words, they are greatly appreciated!!!

I hope that the spreadsheet can help you with tracking your dividends. If you have any comments or suggestions, I would love to hear them!

Thanks for stopping by MDD!

Great month. It won’t take as long to double this month now than it took to get 100.00. 2 companies will pay you more next month from the same 2 I recurved raises from BAC and KR. Keep it up.

Doug recently posted…2019 mid year Goal Update

Yeah. I am excited to see both of those increases. I love seeing those numbers grow month after month! Thanks for stopping by Doug!

Your portfolio is solid for sure. Nice to the see the “DRIPing”, should drive growth.

Man you were busy in June, hope the blog is getting lots of traffic as a result.

Passive Cash recently posted…Passive Income Summary – June 2019

The traffic has been increasing since I have started working on the blog again. The DRIPs are definitely helping me drive growth. Thanks for stopping by Passive Cash!