More Dividends Update from May 2019

Have you been following the action here at More Dividends?

It’s been a long dry spell but with 2 recent buys that dry spell is now officially over. It felt great to do some buying again. It has been way to long.

New stock additions, more dividends received, great year over year growth and even a small shift in my portfolio allocation. Now that sounds like a busy month to me. That isn’t even including all the articles that were published this month!

If you cannot tell by now, I will be a lot more active around. So expect a lot of new content coming in the near future. A lot of new articles are yet to be published. I will have some free downloads coming soon, more on this later 🙂

Until then, let’s take a look at what has been going on over the past month!

Stock Additions

During the month of May, there were 2 new stock purchases. Neither of them were new positions but they did strengthen some of my existing positions. Both of the purchases also allowed me to lower my cost basis which is always a great thing. If the price keeps dropping I would definitely consider adding to either position because I don’t think that I am allocated too heavy in either position.

If you don’t know by now, those additions are as follows:

Both of these are great companies that I have no intention of selling my stock in. So like I said earlier, if the price keeps going down then my share count will keep going up!

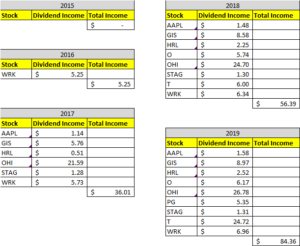

Dividends Received

This month has by far been my best May yet. The dividend increases keep coming and have assisted in the compounding growth that I have been seeing.

Apple (APPL) – $1.58 – Reinvested

General Mills (GIS) – $8.97 – Reinvested

Hormel (HRL) – $2.52

Realty Income (O) – $6.17 – Reinvested

Omega Healthcare Investors (OHI) – $26.78 – Reinvested

Procter & Gamble (PG) – $5.35

STAG Industrial (STAG) – $1.31

AT&T (T) – $24.72 – Reinvested

WestRock (WRK) – $6.96 – Reinvested

May was the second month of Q2 and accounted for $84.36 of my 2019 Dividend Income.

In total during 2019, I have earned $328.54 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 50% increase in dividends earned during the month of May. The addition since last year helped drive this growth as well as the dividends compounding on themselves. Mainly the addition though!

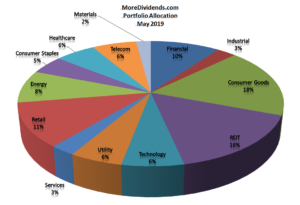

Portfolio Allocation

With the addition of the ExxonMobil and Altria stock this month I did see a small shift in the portfolio allocation. Consumer goods and Energy both gained a little. Since I am not currently too heavy in the Energy sector I am not worried about it at this moment. I will continue to keep my eye on the Consumer Goods sector because it is the sector that I am most allocated too at the moment.

I am also aware that some of my positions in the Consumer Goods sector are down so if they were to go on a rally it would make me extremely heavy in this sector.

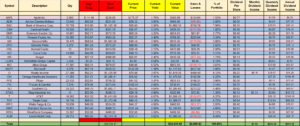

Current Portfolio

At this point I am pretty sure you are aware of the new stock additions. With the dip in the market towards the end of last week my holdings are down a bit but nothing that I am concerned about.

I will continue to keep my eye on the market and look for some more opportunities to make some more buys.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during May from oldest to newest.

5.5% Dividend Increase from Apple (APPL)

More Dividends Update from April 2019

5.6% Dividend Increase from Flowers Foods (FLO)

Recent Buy – ExxonMobil

A little tell of the benefits of limit orders

Another Recent Buy – Altria Group (MO)

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Now wasn’t that a busy month?

It has honestly felt great being able to post about some new buys. The portfolio has been running on autopilot for so long that I was worried that I didn’t even know how to place an order on the stock market anymore.

As it turns out placing orders on the stock market is a lot like riding a bike. You never seem to forget!

I hope that everyone is as excited as I am for the future content that is coming to More Dividends. It will be geared toward beginning investors as well as seasoned pros.

You have heard about what has been going on here lately! Leave me a comment down below and let me know how your portfolio performed during the month of May.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Great month More Dividends! Nice 50% YOY growth too! We share 5 companies (GIS, O, OHI, PG, and T) which are all awesome dividend payers! Keep up the great work! That snowball is really building! 🙂

My Dividend Dynasty recently posted…May 2019 Dividend Income

Thank you for the kind words MDD. It has taken some time to get it rolling this much but it is slowing starting to build up steam. I am excited to see just how big it gets!

Nice month Jason! Really great growth. Looks like this month might be a new record, looking forward to that report.

I calculated your yield on cost at 4.5% …nice!!

Passive Cash recently posted…May 2019 Stock Purchases

If things continue as projected then it will be a new record for me. I am keeping my fingers crossed!!!

I appreciate you letting me know that. I have never really used the yield on cost metric but I have seen a lot of other investors using. Hopefully that number will continue to go up over time. Thanks for stopping by PC!