More Dividends Update from May 2018

May turned out to be a pretty good month. Judging by the Recent Buys From Bloggers series a lot of investors have started slowing down their purchases. Well they are not alone. I have been having some difficulty finding good purchases as well. On a brighter note the new series seems to be doing pretty well. Which by the way, if you post a recent buy article just tweet me the link and I will be sure to include it in the weekly update.

During the month I was able to add to one of my existing positions. I also receive a nice amount of dividend income to be a second month of the quarter. I am very optimistic of what the future holds and I look forward to sharing it.

Until then lets take a look at how my portfolio did during the month of May.

Stock Additions

There was one addition to my portfolio this month. I was able to strengthen one of my existing positions. I think the company is well run despite being very leveraged. If the Times-Warner deal goes through I think it will really help grow this company over to long term. As I am sure you have guess by now my recent addition is as follows:

AT&T (T) – 21 shares – $42.00 to PADI

This addition really helps me toward my goal of $1,000 in dividend income. I am still a long way from it but I am making all the right moves to get me there.

Dividends Received

The second month of the quarter has steadily been growing. With the big payouts from Omega Healthcare Investors and the future big payments from AT&T I could the second month growing as big as the third month of the quarter. If you have been following the blog for awhile you may remember my article titled “When Do I Want My Dividends Paid” where I stated that I didn’t care when my dividends were paid because I am currently just in the accumulation stage. With that being said let’s take a look at how much accumulating that I did this month.

Apple (APPL) – $1.48 – Reinvested

General Mills (GIS) – $8.58 – Reinvested

Hormel (HRL) – $2.25

Realty Income (O) – $5.74 – Reinvested

Omega Healthcare Investors (OHI) – $24.70 – Reinvested

STAG Industrial (STAG) – $1.30

AT&T (T) – $6.00 – Reinvested

WestRock (WRK) – $6.34 – Reinvested

May was the second month of Q2 and accounted for $56.39 of my 2018 Dividend Income.

In total during 2018, I have earned $215.69 in dividend income!

That is 21.569% of my 2018 goal.

So far my dividends received looks like this

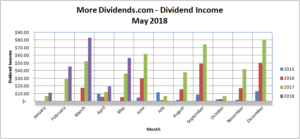

Dividends Received By Year

Year over year, I saw a 56.6% increase in dividends earned during the month of May. Like a lot of months, my additions have helped fuel the growth year over year. This trend will probably continue until I get my positions built up enough so that the reinvested dividends can start doing some of the work. I have been noticing that I seem to be trending a little over 50% YOY growth during most months. I would love to be able to keep this up! Let’s take a look at my YOY comparison.

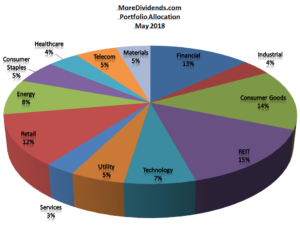

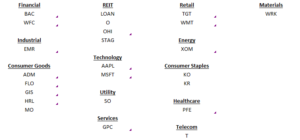

Portfolio Allocation

There hasn’t been a big change to my portfolio allocation. With the recent addition of AT&T, it boosted my position in the Telecom sector. Other than that any changes have all been made due to fluctuations in the market. I am still not sure if I categorize things the best way and I would love to hear your opinions on it. Now let’s take a look at how things are currently allocated.

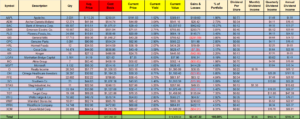

Current Portfolio

Some stocks went up and some stocks went down. Nothing big has happened in my portfolio. It would seem as though I added to my position in General Mills too early. I would love to be able to lower my cost basis in the stock but based on the wording of a Press Release from the company I think that they may have frozen the dividend. So I do not want to add more money until I know for sure. There are a couple of other positions where I could lower my cost basis and I am looking into that as a possibility. As I mentioned in my most recent article I am looking to buy but I haven’t found anything that looked great for me right now. Hopefully that will change soon! Until then let’s take a look at the current portfolio.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during May from oldest to newest.

Dividend Increase – Apple (AAPL)

More Dividends Update from April 2018

Recent Buys From DGI Bloggers – Week Of 4/30/18

Recent Buys From DGI Bloggers – Week Of 5/7/18

Recent Buy – AT&T (T) Again

Recent Buys From DGI Bloggers – Week Of 5/14/18

Dividend Increase – Flower Foods (FLO)

Recent Buys From DGI Bloggers – Week Of 5/21/18

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

What a good month. The portfolio is still producing great growth. Some fresh capital was deployed to strengthen one of my existing positions. I am continuing to educate myself on investing in a lot of different areas. One thing that you may have noticed is that I did not post a review of the book that I read during the month of May. Well don’t worry, I am just running a bit behind and I will be posting it very soon. It was a great book and it is right on point with the subject matter of this blog. For now, I will continue to practise patience as I continue to search for my next investment. A lot of companies have been looked at but I just haven’t been able to narrow it down to one yet. Hopefully I will be able to do that soon!

I am really looking forward to see what the next couple of months have in store for the market and hopefully I will be able to find some great opportunities to buy more stock.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever a new article is published on More Dividends just enter in your information below!

Good progress, Jason. The portfolio will grow nicely with 50% YoY growth. 3-digits months should soon be around the corner!

Engineering Dividends recently posted…Recent Sell – SCG

Thanks ED. I am looking forward to that $100 in one month milestone.