More Dividends Update from April 2018

April was a stupendous month for More Dividends. I am continuing to grow my income for the 1st month of the quarter. It still is lagging the other months but it has gained a lot of ground from where it use to be. During the month, I also made a couple of purchases which will really help me strive for my goal of dividend income for the year. Despite the volatility in the market I am continuing to see a lot of good growth in my portfolio.

I have a lot of new ideas that are currently being developed for More Dividends. I am very excited to start rolling them out over time. Some of these ideas are short term and others are long term.

Until then let’s look at how my portfolio did during the month of April.

Stock Additions

There were 2 major additions to the portfolio during April. I think it is worth noting here that the Southern Company position was actually a sell and a buy that allowed me to reposition the stock in a tax advantaged account.

Realty Income (O) – 7 shares – $42.14 to PADI

Southern Company (SO) – 23 shares – $53.36 to PADI

These additions really help me toward my goal of $1,000 in dividend income. I am still a long way from it but I am making all the right moves to get me there.

Dividends Received

The first month of the quarter is starting to gain a little traction for me. I am very adamant about acquiring good stock and not worrying about when it pays the dividend. With that in mind I still like to see the number going up 🙂

Genuine Parts (GPC) – $4.35 – Reinvested

Coca Cola (KO) – $5.59 – Reinvested

Manhattan Bridge Capital (LOAN) – $.61 – Reinvested

Realty Income (O) – $2.21 – Reinvested

STAG Industrial (STAG) – $1.30

Walmart (WMT) – $5.49 – Reinvested

April was the first month of Q2 and accounted for $19.55 of my 2018 Dividend Income.

In total during 2018, I have earned $159.30 in dividend income!

That is 15.93% of my 2018 goal.

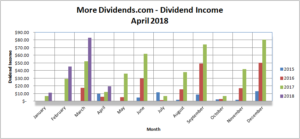

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 57.5% increase in dividends earned during the month of April. Like a lot of months, my additions have helped fuel the growth year over year. This trend will probably continue until I get my positions built up enough so that the reinvested dividends can start doing some of the work.

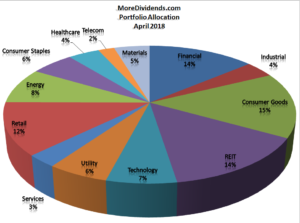

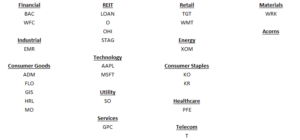

Portfolio Allocation

There has been a lot of changes in my portfolio as of late and because of this there has been a shift in my portfolio allocation. First, you may notice that I removed Acorns because I currently closed my Acorns portfolio. Secondly, the biggest thing that I notice is that the REITs have more capital allocated to them than any other sector. With that in mind I will probably lay off looking at anymore REITs for the time being. I have my eye on another sector so that works out good.

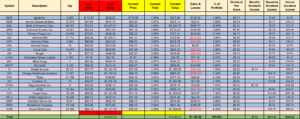

Current Portfolio

As I mentioned above, I have removed the Acorns listing from my portfolio. That is not to say that I don’t bring it back later but for now it is inactive. Also I can see that I have strengthened several of my existing positions in companies like Southern Company and Realty Income. I am also looking to add to another position that I hold but only time will tell if I decide to actually pull the trigger on it. I am looking to allocate more capital into some of my weaker sectors in the near future.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during April from oldest to newest.

More Dividends Update from March 2018

Recent Buy & Sell – Southern Company

Dividend Increase – Southern Company (SO)

What are all of the different types of earnings per share?

Dividend Increase – Exxon Mobil (XOM)

Recent Buys From DGI Bloggers From The Past Week

Unlimited Power by Tony Robbins

Recent Buy – Realty Income (O)

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

What a busy month that I had. While reading Unlimited Power by Tony Robbins I got to learn a lot of new skills. During the month I also received several nice raises. I also was able to put some more capital to work by strengthening some of my positions in Southern Company and Realty Income. My dividends are continuing to drip into my snowball. I was also able to find time to start developing some new ideas for More Dividends that I will begin rolling out soon.

I am really looking forward to see what the next couple of months have in store for the market and hopefully I will be able to find some great opportunities to buy more stock.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook

@MoreDividends on Twitter

If you would like to receive an email whenever a new article is published on More Dividends just enter in your information below!

Nice man. Congrats on the growth.

Keep it up and surely you will hit your goal.

Cheers

Passivecanadianincome recently posted…Don’t Trust Banks for International Money Transfers

Thanks PCI. I know that I set a large goal so I am trying really hard to get there. Thanks for stopping by.

Nice month More Dividends! The snowball will just get bigger and bigger. Before you know it, you will hit the 1k mark! Keep up the good work! 🙂

My Dividend Dynasty recently posted…April 2018 Dividend Income

Thanks MDD. I am very excited about getting there. Thanks for stopping by!

Nice increase. I just reached 1,000$ in forward dividends 🙂 Keep going strong you will get there soon. You have significant exposure to REITs (14%). S&P 500 has around 3%. What is your thoughts on interest rate sensitivity? Do you plan on adding more as the price drops?

dividendgeek recently posted…Dividend Increases This Week (Apr 30 – May 04)

Congrats on reaching the $1,000 mark. I am excited about reaching it myself.

I am a bit heavier than I would like. I think that O and STAG will do fine. The one I am worried about is OHI. Currently, I plan to just hold these positions and look into some other sectors. If the price drops significantly I will revisit the idea of adding more but hopefully by then I will be less than 14%. Thanks for stopping by dividendgeek.

Nice month. April is usually slow for me too. But it picks up in the rest of the year for the most part. Looking forward to seeing more growth from you going forward!

Yeah, the first month of the quarter is always kind of light for me but it has come a long way. Thanks for stopping by.

Congrats on the progress, MD! You’ve got lots of good information you’re sharing… very nice to see.

I see you’ve done very well with BAC… that’s awesome. Another name from your portfolio that jumped out at me is WRK. You’ve done quite well with that company as well. I can’t say I’ve seen WRK in any portfolio before, so nice job uncovering that stock. Keep up the good work.

Engineering Dividends recently posted…Monthly Dividend Income (Apr. 2018)

Thanks ED. Yeah, I bought BAC at a time when everyone was saying to stay away. It has worked out well for me so far. Yeah, I got in on WestRock not long after the merger happened. It is an industry leader that has done well for me so far. Thanks for stopping by.