More Dividends Update From October 2017

Welcome back readers. October turned out to be an interestingly busy month for me. I went and saw several shows during the month but the best one was the performance of Luzia which was put on by Cirque du Soleil. It turned out to be an amazing performance to see. Despite being a busy month for me personally, my portfolio also saw a little activity in it this month. Despite being a 1st month of the quarter, October did end up showing a bit of growth which is always great to see during the slow months.

It is always nice to have your investments working for you! So let’s take a look at how we did during the month of October.

Additions

Even though you only heard about it yesterday. I did actually open my position in Genuine Parts during the month of October. It is a recent buy that I am very happy with. If the share price continues to go down then I will consider strengthening this position. Currently, I have added 6 new shares which will add $16.02 to my projected annual dividend income. I would be very interested to hear about any recent additions that you have made in your portfolio.

Dividends Received

Coca Cola (KO) – $5.22

Manhattan Bridge Capital (LOAN) – $0.50 – Reinvested

Stag Industrial (STAG) – $1.29

October was the first month of Q4 and accounted for $7.01 of my 2017 Dividend Income.

So far my dividends received looks like this:

Dividends Received By Year

Year over year, I saw a 128% increase in dividends earned during the month of October. My Coca Cola position was larger this year as well as accounting for Stag Industrial’s dividend are the contributing factors for such large growth.

Portfolio Allocation

With the recent addition of Genuine Parts I will be listing a new sector on my Portfolio Allocation chart. I have added the Service sector. I know this may seem like a weird sector placement but they are in the wholesale of auto parts industry as well as supplying parts for other industries. Overall, I think I have a very diverse portfolio. I am happy with the current weight of my portfolio.

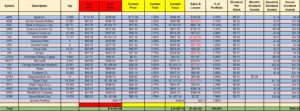

Current Portfolio

With the recent purchase as well as changes in the market my current portfolio looks like this:

MoreDividends.com Articles

Here are the articles that I posted on here during October from oldest to newest.

More Dividends Update from September 2017

Dividend Increase – Omega Healthcare Investors ( OHI )

Dividend Increase – Manhattan Bridge Capital (LOAN)

Steps to getting car loan with damaged credit

Dividend Increase – Westrock (WRK)

If you are interested in posting guest post, just head over to the Contact Page and send me a message.

Conclusion

October turned out to be a good month. I showed some great year over year growth for the month. The only way that I can continue such growth is through the acquisition of more stocks that pay a dividend during the 1st month of a quarter. Every dollar that I can put to work in this portfolio will only help me compound my money that much quicker. Once upon a time I wrote that I didn’t buy stocks based on when their dividend was paid but my lack of income during the 1st month of a quarter is starting to make me reconsider. Plus the new addition during the month will help me continue to grow my overall dividend income stream.

Be sure to follow my new Page on Facebook at Facebook.com/MoreDividendsdotcom

Be sure to follow me on Twitter @MoreDividends

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Nice dividend increase! We are pretty much in the same boat in terms of dividends. Long way to go 🙂

dividendgeek recently posted…Canadian stock dividend increases (October 30 – November 03)

Yeah, you’re right about having a long way to go but getting started is the hardest part and that is already behind us. Thanks for stopping by.

Keep building that passive income stream. It may be a small amount coming in but year over year you killed it. Keep building up those dividends share by share. Nice to see the buying continue with GPC. Some have stopped buying or sold their positions in anticipation of a correction. Just keep building! Thanks for sharing.

DivHut recently posted…Dividend Income Update October 2017

Thanks for stopping by DH. Yeah, I will continue to make good buys to keep building my portfolio. I am hoping that GPC does go through a correction so I can buy some more 🙂

Good job. keep adding and those dividends will keep growing. Also on your insert above that shows dividends and how your stocks are performing Apple now pays .63 and OHI .65 so that will increase your dividend outlook a little. Keep it up

Doug recently posted…OCT 17 Dividends

Great catch Doug. I can’t believe that I missed that. Its always nice to find a little lost money 🙂 Thanks for stopping by.

Love the month More Dividends. Congrats on that awesome dividend growth rate. You better make the most of every dollar and do whatever you can increase your portfolio.

Cheers

Bert

Dividend Diplomats recently posted…Bert’s October Dividend Income Summary

I do, believe me. I try to make every dollar work for me. Thanks for stopping by Bert.

Congrats on another good month and getting that triple-digit increase in percentage from last year. KO is also one of the companies that paid me dividends in October as well. Looking forward to next month’s report.

Dividend Portfolio recently posted…$600 Annual Dividend Income Milestone Reached

With such small amounts coming in on the 1st month of the quarter I will continue to see large growth rates year over year. As my income increases on these months it will be harder and harder to keep producing such growth. KO is a good company that I think will be around for the rest of my life so I am very comfortable owning them. Thanks for stopping by DP.