More Dividends Update from December 2018

Hey there readers. It has been awhile since my last post. Since then I made it through the holidays and into the new year. Plus I did a bit of traveling up to Minnesota. As fun as all of this was, it is but a memory now because I am back home and back to the normal grind.

It is nice to know that while I am out there doing things in life my portfolio will continue to work for me. December saw the highest amount of dividend income that I have received in a single month. There were no real changes to the portfolio outside of the market fluctuations. So overall, I am still pleased with how things are. Let’s take a look at how my portfolio did during December.

Stock Additions

Unfortunately, because of travels I missed some good opportunities in the market. December saw no new stock additions.

Dividends Received

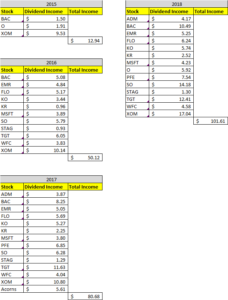

After reaching the $100 milestone in September, I was able to push that record dividend income amount a little bit higher during December. Let’s take a look at how it was able to do that.

**NEW RECORD MONTH**

Archer Daniel Midland (ADM) – $4.17 – Reinvested

Bank of America (BAC) – $10.49 – Reinvested

Emerson Electric (EMR) – $5.25 – Reinvested

Flowers Foods (FLO) – $6.24 – Reinvested

Coca Cola (KO) – $5.74 – Reinvested

Kroger (KR) – $2.52

Microsoft (MSFT) – $4.23 – Reinvested

Realty Income (O) – $5.92 – Reinvested

Pfizer (PF) – $7.54 – Reinvested

Southern Company (SO) – $14.18 – Reinvested

Stag Industrial (STAG) – $1.30

Target (TGT) – $12.41 – Reinvested

Wells Fargo (WFC) – $4.58 – Reinvested

Exxon Mobil (XOM) – $17.04 – Reinvested

December was the last month of Q4 and accounted for $101.61 of my 2018 Dividend Income.

In total during 2018, I earned $720.09 in dividend income!

So far my dividends received looks like this

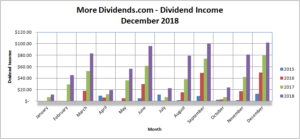

Dividends Received By Year

Year over year, I saw a 26% increase in dividends earned during the month of December. Let’s take a look at the year over year comparison.

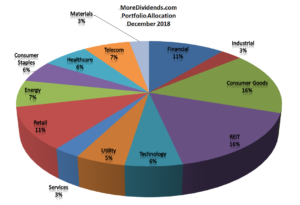

Portfolio Allocation

No changes have been made to the allocation in my portfolio. So I am still happy with the current allocation.

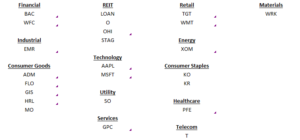

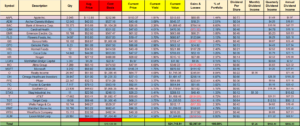

Current Portfolio

The market has seen a lot of swings since my last update. Lately, it has been more down than up. Despite these facts I am still very happy with how my portfolio has been holding up.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during September from oldest to newest.

Recent Buys from DGI Bloggers – Week of 12/3/2018

More Dividends Update from November 2018

.2% Dividend Increase from Realty Income ( O )

2% Dividend Increase from AT&T ( T )

5.9% Dividend Increase from Pfizer Inc. ( PFE )

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Another month with no new purchases. While I haven’t rushed into a new purchase recently, I am definitely ready to purchase something soon. Now that the holidays are over it will be a perfect time to start researching again.

So during December, the portfolio mainly operated on auto pilot. I had a record month of dividend income. Every dollar reinvested only helps me reach FI even sooner.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever a new article is published on More Dividends just enter in your information below!