More Dividends Update from March 2018

Another month is in the books. I hope that everyone had a fantastic month during March. I am very excited about this update because it is full of a lot of good news. A lot has been going on like making some purchases, setting a personal best in dividend income and I am setting up More Dividends for more success in the future. The market has been very crazy lately but I have been trying to use these swings to my advantage. I will continue to look for more opportunities in the future to make some more purchases.

I am working towards building on some areas of the site. So if you are interested in having your website listed on my blogroll just let me know in the comments.

So let’s take a look back and see how my portfolio has changed during the month of March.

Additions

There were 2 major additions to the portfolio during March. Both of them are new positions and I look forward to building onto them in the future.

Altria Group (MO) – 7 shares – $19.60 to PADI

AT&T (T) – 12 shares – $24.00 to PADI

These additions really help me toward my goal of $1,000 in dividend income. I am still a long way from it but I am making all the right moves to get me there.

Dividends Received

March produced the most dividend income for me yet. I am highly anticipating the $100 in a single month milestone. I should be able to reach this milestone very soon.

**NEW RECORD MONTH**

Archer Daniel Midland (ADM) – $4.08 – Reinvested

Bank of America (BAC) – $8.28 – Reinvested

Emerson Electric (EMR) – $5.09 – Reinvested

Flowers Foods (FLO) – $5.74 – Reinvested

Kroger (KR) – $2.25

Microsoft (MSFT) – $3.82 – Reinvested

Pfizer (PF) – $7.34 – Reinvested

Southern Company (SO) – $6.35 – Reinvested

Stag Industrial (STAG) – $1.30

Target (TGT) – $11.74 – Reinvested

Wells Fargo (WFC) – $4.07 – Reinvested

Exxon Mobil (XOM) – $15.52 – Reinvested

Acorns Portfolio – $5.19 – Reinvested

March was the last month of Q1 and accounted for $82.97 of my 2018 Dividend Income.

In total during 2018, I have earned $139.75 in dividend income!

That is 13.975% of my 2018 goal.

So far my dividends received looks like this

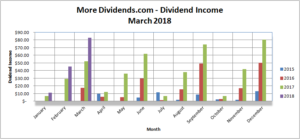

Dividends Received By Year

Year over year, I saw a 59% increase in dividends earned during the month of March. The reinvested dividends helped out here but the additions were the real powerhouses. I hope to be able to continue producing this kind of year over year growth but I am seeing the growth rate slow down the larger the amount of dividend income grows. I do not mind as long as I continue seeing growth because I will not be able to keep up the growth by purchases alone.

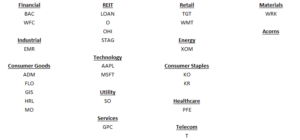

Portfolio Allocation

With these new additions in the portfolio I notice a shift. Consumer goods now seems to be my heaviest sector. I will continue to keep a watch on this while looking for some opportunities in some other areas. Underneath the usual pie chart I have included a list of how I classify each company that I own. I am in debate on some of them but will leave them as is for now. If you have any thoughts on the way I categorize them, I would love to hear them in the comments.

Current Portfolio

I can see in this new image that several of my positions have went in the red so I will keep an eye on them. It may prove to be a good opporunity to lower my cost basis. Overall though I am happy with the current state of my portfolio.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during March from oldest to newest.

More Dividends Update from February 2018

Recent Buy – AT&T (T)

Dividend Increase – Realty Income ( O )

Top 5 Podcast – 2018

The Compound Effect by Darren Hardy

Recent Buy – Altria Group (MO)

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

What a great month. This was the type of month that gets me excited about what I am doing here. The additions will help me build up this stream of income along with the reinvested dividends. I will continue to look for great opportunities to expand this portfolio. It is doing great and producing some superb results for me.

I want to take a minute and thank everyone in the DGI blogging community. I have been able to meet and talk to a lot of great people who I am able to learn from. In the years that I have been apart of this community not once have I ever seen any negative comments. Someone may disagree with a point of view but it has always been handled with the appropriate decorum. I am glad to be apart of this community and I appreciate and respect everyone else who is involved.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook

@MoreDividends on Twitter

If you would like to receive an email whenever a new article is published on More Dividends just enter in your information below!

Keep up the good work. It must feel great hitting a new dividend milestone. Keep on your track and I’m sure more records will follow. As always, it’s nice to see some names in common paying us. I see a handful of similar stocks paying us both. Like you, I’m also looking at some of my positions that are in the red for future potential buys but want to be careful not to get too heavy in any one name as a result.

DivHut recently posted…April 2018 Stock Considerations

More Dividends,

Amazing stuff! That’s awesome that you set a new record and posted one nice dividend growth rate along the way. That’s what I’m talking about. As Divhut said, we have some very similar names on our list for the month, which is always great to see. Keep pushing and keep on striving for that next great record. Cheers!

Bert

Dividend Diplomats recently posted…Expected Dividend Increases in April 2018

Super month More Dividends! You are very close to the $100 per month mark! I have no doubt you will pass it! Congrats and keep up the great work! 🙂

My Dividend Dynasty recently posted…March 2018 Dividend Income

Jason, It’s really a lot of fun to watch the dividends grow. Very rewarding. Keep it up. Tom

Tom from Dividends Diversify recently posted…You Gotta Eat

Woohoo, congrats on the record month! It’s fun to see those numbers grow.

timeinthemarket recently posted…Time in the Market dividend review – March 2018 – mutual fund dividends