More Dividends Update from September 2021

September turned out to be an amazing month for me. The More Dividends portfolio was able to record it’s largest amount of dividend income received in one month. Plus I made some moves in the portfolio on the buy and sell side as well. This was not a move that I am accustomed to making but I felt that it was necessary in this instance. I will discuss this in more details later.

Plus I made some interesting plays in the crypto space which are not actually apart of the More Dividends portfolio but I will discuss them a bit in this article because I do think it is a good investment for an investor who is allocating some capital into the alt coin space.

Like I said, September turned out to be a very great month but not just for the portfolio.

I personally spent a lot of time working in the beginning part of the month. So towards the end of the month, I took more time to myself to do some things that I enjoy like hiking and playing disc golf.

I did a couple of local hikes, one including a sunrise hike up a mountain and a few more casual trails. I also spent more time on the disc golf course including working on my drive as well as getting to play a few more courses which is always thrilling.

Both are great hobbies which help keep me active as well as neither of them are very expensive hobbies.

Enough of the standing around and chatting, right?

How about we go ahead and jump into the report and let’s take a look at how we did over the past month.

Crypto Additions

So let’s cover the recent additions to my crypto portfolio. While I do not publish complete crypto portfolio, I will tell you for the most part it just consist of Bitcoin. I do hold a few small positions in some alt coins which I only hold for growth and then I have been building a position in a stable coin to help balance out this portfolio.

Recently, over the past 2 months I learned about the XY Oracle also known as the XYO Coin. I learned that I was able to acquire small amounts of this coin using an app called Coin. After learning about the ideas and the technology I really started to believe in the coin. I started earning more but I started seeing a lot of bull trends in the price of the coin so I knew that if I was really going to capitalize on the growth that I was gonna have to move some more money into this space.

So I made a few buys over a couple of days and I acquired around 30k of these coins. Currently, I have just been sitting on this position but there has been a lot of movement again so I may begin to look into adding to the position.

If you are reading my blog then look to learn more info about these coins and my crypto portfolio in the near future. A lot of new interesting things are in the works! 🙂

If you are currently holding any $XYO coins then I would love to chat with you on Twitter about it. Just send me a tweet.

Stock Sells

Here we will get into the strategy that I had mentioned during the introduction. Anyone who has been reading my articles over the years will know that I am not a big fan of ever selling my stock. I do the research on these investments up front and I truly believe in the company when I decide to invest my money. With that being said, I sleep really well at night.

Despite, this being a pretty strong rule with me I had recently been researching and looking to expand my portfolio allocation some.

Upon a review on how my portfolio had been performing I knew that my position in Target had done very well. I decided to sell off 4 shares at a gain around 245%. I still maintained a bulk of the position but I decided to sell off this small piece, collect the gains and then to reinvest the proceeds to help expand my portfolio allocation.

Stock Additions

Now it appears as though we have reached the time for the big reveal in this report. If you have already been following me on Twitter than you may have already seen me talking about this acquisition.

After doing my research, I had decided that I wanted to allocate some capital to the defense sector. Up until this point I have had no positions in this sector and with things getting shaky politically on a global scale I figure that now would be a good time.

So after putting in the time to study the different companies I finally decided that I wanted to start a position in Lockheed Martin. So I used the money from the sale of the Target stock to buy 4 shares of Lockheed Martin.

The great news was just beginning because the week after I started the position Lockheed Martin increased their dividend by 7.7%.

So not only did I buy stock in a company that I believe in but then they turn around and reward me by increasing the dividend.

Hey like I said, September turned out to be a great month.

Dividends Received

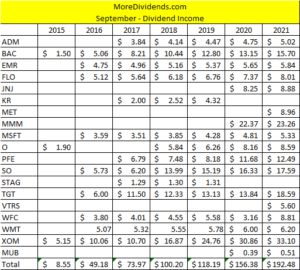

September we killed it with a new record high of dividend income received in a single month. I am projecting to reach my next milestone of receiving over $200 in a single month by the end of the year. I am really looking forward to that.

If I am able to keep pushing my record highs, then that means that my investing strategy is really beginning to pay off.

So, let’s have a look at what companies paid me a dividend this month.

Archer Daniel Midland (ADM) – $5.02 – Reinvested

Bank of America (BAC) – $15.70 – Reinvested

Emerson Electric (EMR) – $5.84 – Reinvested

Flowers Foods (FLO) – $8.01 – Reinvested

Johnson & Johnson (JNJ) – $8.88 – Reinvested

Metlife (MET) – $8.96 – Reinvested

3M (MMM) – $23.26 – Reinvested

Microsoft (MSFT) – $5.33- Reinvested

Realty Income (O) – $8.59 – Reinvested

Pfizer (PF) – $12.49 – Reinvested

Southern Company (SO) – $17.59 – Reinvested

Target (TGT) – $18.59 – Reinvested

Wells Fargo (WFC) – $8.81 – Reinvested

Walmart (WMT) – $6.20 – Reinvested

Exxon Mobil (XOM) – $33.10 – Reinvested

Ishares Muni Bond Fund (MUB) – $0.51 – Reinvested

September was the last month of Q3 and accounted for $192.48 of my 2021 Dividend Income.

In total during 2021 so far, I earned $1170.90 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

September was really amazing all the way around. Can you believe that not only was it a record breaking month for me but the portfolio was actually able to produce 23% growth for income received year over year. Those are great results which are really helping with the compounding of this portfolio.

The year over year growth is so strong for this month because of thee amounts of dividend income that are received. I am hoping to continue producing this kind of growth during these last months of the quarter.

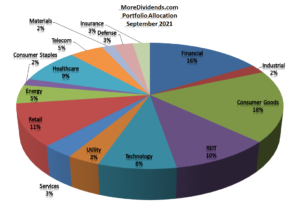

Portfolio Allocation

My portfolio allocation has slightly shifted overtime. With this recent addition to the portfolio I have included Defense as a sector on this allocation. I have recently been considering going in and changing the way that I look at this allocation but if I do decide to do that then I will report on that in the future.

Until then, I am currently happy with the allocation. I expect there to be minor shifts with the markets but I have been not making any major movements other than thee slight shift from retail to defense.

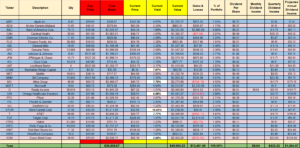

Current Portfolio

I am loving the way that the portfolio is looking these days. It is chugging along and growing over time. With each new addition that is just more dividend income that can be produced and then reinvested back into the portfolio. I am looking to continue to add new capital regardless of what the markets are doing.

So look for more movement in the portfolio in the near future.

MoreDividends.com Articles

Here are the 7 articles that I posted on MoreDividends.com during September from oldest to newest.

Maximize Your Credit Card Rewards!

More Dividends Update from August 2021

Store Capital Increases Their Dividend by 6.9% in 2021

Microsoft Increases Their Dividend by 10.7% in 2021

Realty Income Increases Their Dividend by 0.2% in 2021 For The Second Time

Evolution of Tracking Expenses

Lockheed Martin Increases Their Dividend by 7.7% in 2021

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

See now didn’t I say that this was an exciting month. We had some new buys and we had some new sells. Not only were we buying stocks but we were also buying crypto as well. Something that I didn’t mention earlier in the article but I will mention now is that I also added to my physical coin collection.

So all in all during September my net worth went up. I feel like I I made some pretty good investment moves to help set myself up for the future and it will help me continue to enjoy this game known as life!

As always I look forward to reading all of your comments and questions, until then….. happy investing!!!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

dd

Great month MD! Love seeing when others hit new personal bests. And glad to have you as a fellow LMT shareholder.

JC recently posted…Dividend Update – September 2021

👍👍 Hoping to see many more months such as this!

SD Growth recently posted…Buys and Sells for the Week 10/8