Maximize Your Credit Card Rewards!

Have you ever gotten a bad reward? No? Me neither.

There are a lot of different ways that people can be rewarded. Most often rewards are given when you achieve something. In this article, we will not only talk about rewards but we will also talk about how to maximize those rewards. Just be forewarned that there will be affiliate links in this post.

Where to begin?

To start with you will need to have a credit card. There are plethora of different cards out there that all offer a very wide range of benefits. I am a big fan of cards that offer some type of rewards as well as having a very long 0% interest introductory period.

Two of my favorite cards that I use are both offered from American Express and I got both of them for different reasons.

The first card from American Express I got was because of the cash back rewards. I used it to make all of my purchases at the time and would receive anywhere between 1% to 3% cash back rewards. These benefits are very common but at the time I also received a $400 sign on bonus for getting the card.

The second card that I got from them was because of the Delta Skymiles. At this point, I have been playing the credit card game for years and was looking for something more than just cash back rewards. So since, I have gotten bitten by the wanderlust, I decided that I wanted to start collecting skymiles and not just cash back rewards.

If you are interested to see what kind of benefits these card currently offers just check out all the American Express Credit Cards that are offered.

After the credit cards

Now that we all have a credit card in hand the real fun can begin. At this point, you could just start shopping and using your new cash back rewards card and collecting all of the cash back rewards but if you did that then you wouldn’t be maximizing your earning potential.

The next step that I would do is to go download and sign up for an app called Bumped.

After you have downloaded and installed Bumped, the next thing you will want to do is link your credit cards to the app.

The main purpose of Bumped is to be a customer loyalty app that actually pays you in stock instead of cash back. Essentially, it works similar to cash back rewards because you are paid based on a percentage of your purchase.

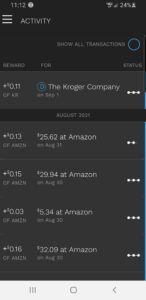

So for instance if I buy something at Amazon for $25.62 instead of getting the $0.13 in cash back rewards, it actually gives me $0.13 of stock in Amazon. While this may not seem like a lot, I can assure that if you will set this system up that your account balance will grow rather quickly. Another great benefit is the fact that you will also get paid dividends on the fractional shares that you hold in your Bumped portfolio.

Currently, I have been participating for a little over a year and have over $100 in the account. I was rewarded that money for doing nothing extra. I mean, I was going to buy the products anyways so why not get some type of return on them.

I just continue to let this account grow and never try to sell anything out of it. It is just another added reward for me using my credit card.

How else can we maximize our rewards?

That’s right…. we are not done earning rewards yet.

There are apps out there like Swagbucks, Mypoints and Ibotta, that will pay you cash back rewards as well. Depending on the platform, they may pay you in cash or gift cards.

I personally tend to shop through Swagbucks a lot. I like them because I am able to cash out using Amazon gift cards. They make great gifts or sometimes I will apply them to my orders when I purchase something on Amazon.

I have used MyPoints in the past but have not used it recently. I have heard a lot of great things about Ibotta even though I have never used it personally.

There are plenty of options for cash back apps. As a matter of fact, check out the best cash back apps as listed on NerdWallet.com.

Free Rewards for Nothing

Now, if we look at the strategy that has been laid out, we have taken a simple purchase of an item and added 3 different rewards to it.

Take for instance your grocery shopping because everyone has to eat and let’s apply this strategy. So you go to Kroger and spend your hard earned money to buy some groceries. You could just pay with cash or debit card and be done with it.

Instead though, you will use your cash back rewards card so that you can collect the cash back rewards there. Then, since you are shopping at Kroger, you will receive a fractional share of Kroger stock which will pay you dividends into the account. Now, while in Kroger you decide to use the Coupons that you have on your MyPoints app at checkout time.

So now, you have created 3 small sources of income off doing nothing more than purchasing your groceries. Which is something that you would have had to do anyways.

In Conclusion

I have said for years now that I am not here trying to always hit home runs. Sometimes my strategy entails setting up systems like this which will continue to produce me little singles and doubles through out the game.

If you are always trying to hit home runs, then you are more likely to strike out than not. If you consistently hit singles and doubles then you will surely win the game. Especially if it is singles and doubles like this where you set the systems in place and they pretty much take care of themselves so all that you have to do is to shop and collect rewards.

Do you employ a similar strategy when it comes to cash back rewards? If so, I would love to hear about it in the comments down below.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Jason, thanks for the overview and suggestions!

Another strategy for maximizing credit card rewards (for anyone with more than one card) is making sure that you choose the card at checkout that will reward you the most. Sounds straightforward, but I’ve found that I often forget about rewards like rotating categories and shopping portals when I’m checking out.

So I recently created a Chrome extension called AddUp Rewards that reminds users of earning opportunities for their cards at the retailers they visit. This has really helped me maximize my credit card rewards, and I know it can others as well.

Here’s the link to the extension in the Chrome Web Store: https://chrome.google.com/webstore/detail/addup-credit-card-rewards/dbankcfkhcbaagbmljfplpmfenkdfifl

Shane Jacobeen recently posted…Hello world!

Great info. Thanks for Sharing.

I was also thinking recently about maximizing my credit card rewards but wasn’t sure about the consequences. After reading your article, I have come to know about the pros and cons about it. And I have the experience of shopping at Kroger and I have been benefited like you have mentioned in your article. Thanks for sharing!

This app is very helpful for numerous easy options for us to earn extra cash while redeem gift cards. Within my first 2 days of using the app, I managed to earn enough swag bucks after redeem a 10 dollar amazon gift card just after three days later. I definitely recommend it to everyone for using this.