More Dividends Update – July 2016

As we all know July is just one of them months that doesn’t produce a lot of dividend income compared to other months. This is especially true when you are just starting to build up a portfolio as I am. Even though July was not a great month for me as far as dividend income is concerned, there has been a lot of other progress going on around here and I can’t wait to let you know about it. I will be updating the Dividend Income and Portfolio pages today as well to reflect the changes that have occured. Well let’s go ahead and break down the month of July and see how it turned out.

Additions

During the month of July I did add some stocks to my holdings. Target (TGT) has been a darling in the DGI blogging community lately. I was really torn between starting this position or starting a position in Flowers Foods but I just felt like there would be more volatility in the future with Flower Foods and that I could get it for a better price. Hopefully this proves to be a good decision.

I also decided that I was going to slowly start building a position in Apple (AAPL) using Loyal3. I had made the decision before the earnings report but did not start until after. I am totally ok with this because I plan to dollar cost average my way into this position since I do not have to pay trade commissions as I build this position.

Target Corp (TGT) – 10 shares with a cost basis of $739.95 ($12.00 in dividend income for 2016)

Apple Inc. (AAPL) – .971 shares with a cost basis of $100.00 ($0.82 in dividend income f0r 2016)

This will add $12.82 to Dividend Income for the year

Dividend Increases

During the month of July some of the Dividends that I received were actually raises for me. It is always nice to get a raise for doing absolutely nothing! Getting these raises is the whole principle behind dividend growth investing. As long as the companies continue to grow their dividends then I will continue to hold the stock.

Manhattan Bridge Capital Inc. (LOAN) – $0.085 to $0.09 – 5.9% increase

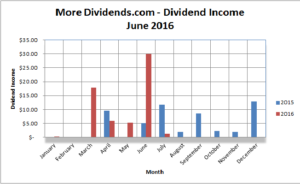

Dividends Received

During the month of July I received some Dividend Income. This was not a great month for me but it will be a completely different story when I hit the first month in Q4.

Coca Cola (KO) – $0.81

Manhattan Bridge Capital Inc. (LOAN) – $0.41 – Reinvested

In total June accounted for $1.22 of my projected 2016 Dividend Income.

July was the first month of Q3.

So far my dividends received looks like this

Dividends Received By Year

Here we can plainly see YoY why I received so much less in dividend income this month. I made a couple of sells last year that negatively impacted my dividend income during this month. I regret not holding all of the stock that I had during this time last year…… but I live and I learn.

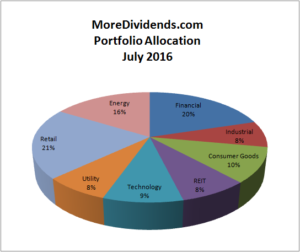

Portfolio Allocation

With the recent addition of Target Corp to my holdings it has actually made Retail to be the sector that I have the most capital allocated to at the moment. I would like to get the allocation by sector down smaller but no one sector currently has too much capital allocated to it so I do not see a big problem with my current allocation.

Seeking Alpha Articles

July was a pretty busy month for me. I did however publish another article on Seeking Alpha. I welcome everyone to read it and to comment on it. In the future I am looking to publish more than 1 article a month. It has been a small learning curve to figure out exactly how the editors want the articles but I think that I have a pretty good grasp on it now and if that is the case then it will be no problem to get more published during a month.

Manhattan Bridge Capital: Whats The Deal?

MoreDividends.com Articles

Here are the articles that I posted on here this month. This is another area that I am looking to add more content to during the next month.

MoreDividends Update – June 2016

Let Your Rewards Truly Reward You

More Dividends Watch List – FLO & TGT

Recent Buy – Target ( TGT )

Manhattan Bridge Capital: What’s The Deal?

Advantages of Health and Wellness

Other Projects

During the month I was able to work on expanding the blog some. So to start with I added a Contact Me page to the blog. Just go to the page and fill out the form and it will send me an email.

Also and even better than that I put together some forums here on More Dividends. So far it has been kind of slow while doing a soft opening but I am hoping that things will pick up. I look forward to seeing some familiar names show up in the forums and engage in some discussions. There is a forum for all kinds of discussion from an introduction forum to dividends and even real estate investing. I have even added a few off topic forums. Please let me know what you think!

Conclusion

My dividend income was almost non existent this month but that’s ok. I can guarantee that I will have a much better start to Q4 🙂 I plan to keep adding new capital to my holdings as I see fit. Sometimes that will be opening a position or sometimes that may be dollar cost averaging my way in. I will continue to navigate those decisions as they arise. I want to get more writing done this month and continue to build a website where people can stop by and enjoy good conversation with other like minded people.

I am enjoying this journey that I am on to achieve financial freedom and am glad that you have chosen to be apart of this journey with me. I look forward to hearing from you! Please feel free to leave me any questions or comments until then happy investing!

Not the month you may have wanted but hopefully you will have better months coming up as you allocated your money differently. I think August will be a big month as you got OHI so you will get almost $10 just from that based on your portfolio

Stefan – The Millennial Budget recently posted…How To Find Your Retirement Number

Yep. I just keep building for the future…. not today. As the portfolio grows I’m sure that the off months will start filling out some. I just can’t seem to justify buying a stock based on the parameter of it paying a dividend during a certain month. Thanks for stopping by!

Dividends are dividends no matter how large or small. It’s all about building on what you have started and going forward I think you’ll be putting up some impressive year over year gains. Just keep sticking to those high quality names and buy when you can. Thanks for sharing.

DivHut recently posted…August 2016 Stock Considerations

Oh yeah… yeah moving forward I should start to see nothing but year over year gains. I try to stick to nothing but high quality names as I build my holdings up. I hope that all has been well. Thanks for stopping by!

As you replied to Divhut above, you are going nowehere but up going forward. Does the decrease suck, sure. But now you have move on and looking forward! Looks like you had a busy month of activity and took some major steps to increase your blog and get your name out in the community. Keep at it and you will see the dividend snowball start to roll and pick up some steam!

Bert

Dividend Diplomats recently posted…Lanny’s July Dividend Income Summary

I guess you have to get knocked down before you can get back up. Yeah I like to always be productive rather its doing investment research or expanding the site and creating value. I appreciate your kind words Bert. Thanks for stopping by.

I like both of your buys this past month. TGT and APPL are great stocks.

Investment Hunting recently posted…Options Income And Trades – July 2016

Yeah I felt like TGT was too good to pass up and I am going to continue to build my position in AAPL. Thanks for stopping by.