More Dividends Update from January 2022

January came with a lot of good news. I was able to increase my dividend income for January despite not being able to break the $100 a month mark. I am almost positive that I will be able to break it next January 🙂

Surprising though, that was not the good news. With the new year came a new job. I have been there a couple of weeks now and things have been going great. Seems like a great team to work with and I have been settling in nicely. The future seems so optimistic right now. I am excited to see what will come next!

Even though I didn’t make any new stock additions during January, I am happy to report that I have begun buying again so look for more information on that during the next few articles.

I have also started making contributions to some other positions in my portfolio but I will go over this in a future article to be released.

Until then, let’s take a look at how well we did in dividend income during the month of January.

Dividends Received

With the addition of Altria Group a few years ago, the dividend income during the first month of the quarter really began to improve. Overtime, I have added some solid companies to the portfolio that just happen to also pay their dividend during this month. When a company pays its dividend has never been a factor when I am deciding to invest in a company or not.

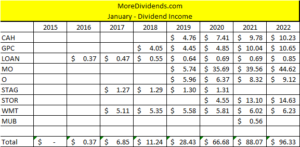

So, let’s have a look at what companies paid me a dividend this month.

Cardinal Health (CAH) – $10.23 – Reinvested

Genuine Parts (GPC) – $10.65 – Reinvested

Manhattan Bridge Capital (LOAN) – $.85 – Reinvested

Altria Group (MO) – $44.62 – Reinvested

Realty Income (O) – $9.12 – Reinvested

Store Capital (STOR) – $14.63

Walmart (WMT) – $6.23

January was the first month of Q1 and accounted for $96.33 of my 2022 Dividend Income.

In total during 2022 so far, I earned $96.33 in dividend income!

With these dividends reinvested, I was able to add $23.84 to my Projected Annual Dividend Income (PADI).

So far my dividends received looks like this

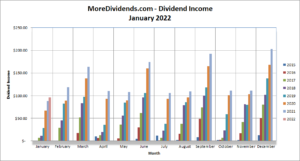

Dividends Received By Year

January has proven to be one of my weaker months when it comes to dividend income. Despite saying this, I still managed 9.4% growth year over year. This kind of growth has been the norm for too long. With new purchases coming look for new growth to start flowing into the More Dividends portfolio.

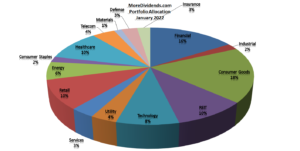

Portfolio Allocation

No recent purchases so there hasn’t been much of a change to my portfolio allocation. Any changes have all been generated by the fluctuations in the markets. Needless to say, I am content with the current state of the portfolio allocation.

Current Portfolio

The current portfolio looks pretty good but the future portfolio looks outstanding. I am hoping to generate some more growth in the portfolio through new infusions of new capital.

MoreDividends.com Articles

Here are the 5 articles that I posted on MoreDividends.com during January from oldest to newest.

More Dividends Update from December 2021

Viatris Increases Their Dividend by 9% in 2021

What there is to know about Mastermind Groups!

Archer Daniels Midland Increases Their Dividend by 8.1% in 2022 !!!

Wells Fargo Increases Their Dividend by 25% in 2022 !!!

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

New year and a new job. I am feeling very optimistic. Life is very exciting right now. I am looking forward to my future team that I will be working with at my new company.

With all of this optimism, I intend to put a lot of that energy into the portfolio as well as some other projects that I have in the works.

I am excited for the future!!! 🙂

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

Facebook: MoreDividendsdotcom

Twitter @MoreDividends

Instagram adventurous.md

If you would like to receive an email whenever I publish a new article:

So close to $100 you will get it next January for sure. Keep growing those dividends

Doug recently posted…January 22 Dividend And Portfolio recap