More Dividends Update from September 2019

September ended up being a new record month for me! I am excited to grow the monthly income record to the all elusive $250 a month milestone. I will continue to make wise purchases to continue to build this portfolio. I want to be sure and build a solid portfolio that will perform well during all parts of the business cycle.

Some great news that I have received so far this month is that one of my brokers will now be offering $0 commission trades starting on Wednesday. This will be very exciting to me because it will allow me to continue taking nibbles and building up some solid positions.

Stock Additions

No new additions during September. With the new change at my broker to $0 trade commissions expect this to change very soon!

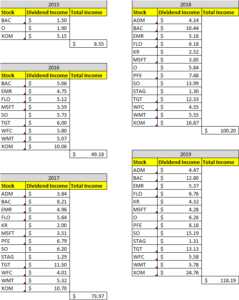

Dividends Received

This September was a record month for me! Over $118 was generated this month through dividend income. Since most of these positions have their dividends reinvested it only helps in fueling the accumulation. This is the great thing about dividend income, it continues to work and create cash flow while I am off generating more cash to put into my More Dividends Portfolio.

Archer Daniel Midland (ADM) – $4.47 – Reinvested

Bank of America (BAC) – $12.80 – Reinvested

Emerson Electric (EMR) – $5.37 – Reinvested

Flowers Foods (FLO) – $6.76 – Reinvested

Kroger (KR) – $2.32

Microsoft (MSFT) – $4.28 – Reinvested

Realty Income (O) – $6.26 – Reinvested

Pfizer (PF) – $8.18 – Reinvested

Southern Company (SO) – $15.19 – Reinvested

Stag Industrial (STAG) – $1.31

Target (TGT) – $13.13 – Reinvested

Wells Fargo (WFC) – $5.58 – Reinvested

Walmart (WMT) – $5.78 – Reinvested

Exxon Mobil (XOM) – $24.76 – Reinvested

September was the last month of Q3 and accounted for $118.19 of my 2019 Dividend Income.

In total during 2019, I earned $676.23 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw an 18% growth rate year over year. That is phenomenal. If you have been reading along on my journey you will remember me saying that as the portfolio got larger that it would be very difficult to continue to produce huge growth rates.

I am very proud to say that 5 years in so far and I am still able to produce 18% growth on my biggest month for dividend income. I would love to continue seeing this high double digit year over year growth.

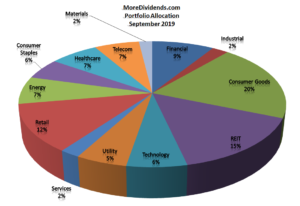

Portfolio Allocation

With no real additions into the portfolio since my last report that means that the market has caused any fluctuations in my portfolio allocation.

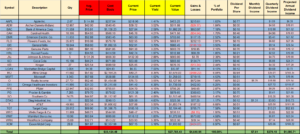

Current Portfolio

No major changes have happened in the portfolio this month. Reinvested dividends continue to add to my nest egg. If we can get through the rest of this year without a huge drop in the market, I would love to be able to grow this to a total of $30k in portfolio value.

I am going to keep my fingers crossed but I am not going to rush into some purchases just to try and achieve this goal. I want to only make well thought out purchases during the rest of the year. This will be very important as the year comes to an end.

Lets take a look at how the portfolio looks right now.

MoreDividends.com Articles

Here are the 3 articles that I posted on MoreDividends.com during September from oldest to newest.

More Dividends Update from August 2019

Microsoft Increases Their Dividend 11%

Realty Income Increases Their Dividend 0.2%

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

It is nice to know that while I am focused on some other aspect of life, that the portfolio continues to keep working for me. A new record month in dividend income leads to more money to be reinvested into the portfolio.

With the announcement of the $0 trade commissions I can only imagine that you will see me making more smaller purchases. This will allow me to dollar cost average more into these positions. Hopefully this will help me drive my cost basis lower on all assets in the portfolio.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Congrats on a triple digit income month and setting a new record. Great news about the $0 commissions moving forward. The option to make small purchases time and time again is a great way to grow your portfolio.

Engineering Dividends recently posted…A of I – Looking Over the Dividend Kings

Hey, could you share how you select stocks in the market to earn dividends? I would like to backtest it.

Johndeoresearch recently posted…Best way to find less volatile stocks

That is a great idea for an article. I will have to keep that in mind!