More Dividends Update from August 2019

Another month is in the books. August turned out to be a great month for me. I put in 3 good solid weeks at work and then I took the end of the month off to do some traveling.

My adventures found me flying into Minneapolis, Minnesota and spending the night about an hour outside of the cities. The next morning we got up early and set out on a road trip to Wisconsin Dells, Wisconsin. If you have never been to this town, I would highly recommend that you visit in during the summer months.

Wisconsin Dells has a lot of water parks as well as a lot of water activities on beautiful Lake Delton. After a few days of doing some shopping and some playing, we made our way back to Minnesota. Then I stayed in Minnesota for a few more days before flying back into Atlanta.

Needless to say, I made it home safely and am ready to go back to work this weekend.

Until then, let’s take a look at what all has been going on in the portfolio since last month.

Stock Additions

With my recent travels, I am a little bit behind on posting some of my articles but I did recently make a new purchases in my portfolio.

There were several companies that I was looking at. Everytime I would get excited about one, I would end up finding some reason why I didn’t think that it would work out good in my portfolio.

After a lot of debate, I decided to add 5 shares of Johnson & Johnson to the More Dividends portfolio. Expect a full article coming soon about the purchases. Some quick points about it though. The healthcare sector had less capital allocated to it than some of the other sectors. I have been wanting to start a position in JNJ for a couple of years now. With all the recent publicity about the court cases I decided to go ahead and start a position at these levels.

Dividends Received

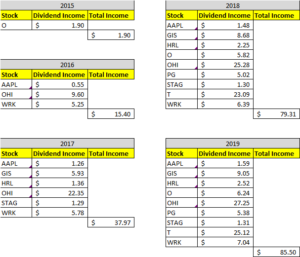

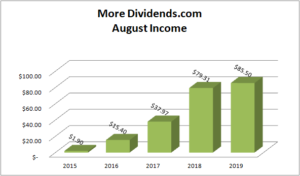

Let the dividends keep flowing! I have been at this for 5 years now and it is amazing to see how much I have received in dividends. Let’s take a look at how we did last month.

Apple (APPL) – $1.59 – Reinvested

General Mills (GIS) – $9.05 – Reinvested

Hormel (HRL) – $2.52

Realty Income (O) – $6.24 – Reinvested

Omega Healthcare Investors (OHI) – $27.25 – Reinvested

Procter & Gamble (PG) – $5.38

STAG Industrial (STAG) – $1.31

AT&T (T) – $25.12 – Reinvested

WestRock (WRK) – $7.04 – Reinvested

August was the second month of Q3 and accounted for $85.50 of my 2019 Dividend Income.

In total during 2019, I have earned $558.04 in dividend income!

So far my dividends received looks like this

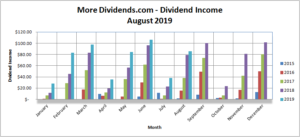

Dividends Received By Year

Year over year, I saw a 7.8% increase in dividends earned during the month of August. As we can tell, this increase was all created because of the dividends being reinvested.

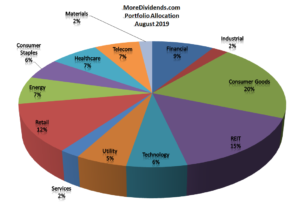

Portfolio Allocation

With the addition of the JNJ stock that did add a little bit of weight to the healthcare sector. Other than this small addition all of the other changes in my portfolio allocation has been caused by market fluctuations. Currently, things are spread out pretty even. Some of the other sectors are weighted a little bit heavier but there isn’t one sector that is just way to overweight.

So I am very happy with my allocation right now and will allow the market to keep playing with these numbers for now.

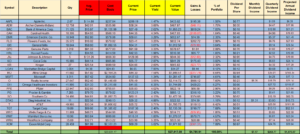

Current Portfolio

I am very pleased with where the portfolio is right now. I have been slowly making new additions which has been helping me increase the amount of dividend income that I have been receiving. I have been paying attention to the weighting of my portfolio as I have been making these additions. I will continue to keep the capital allocation as a consideration in the future but it’s impact may not be quite as strong as it has been.

MoreDividends.com Articles

Here are the 6 articles that I posted on MoreDividends.com during August from oldest to newest.

Recent Purchases By Dividend Growth Investing Bloggers!

Altria Group Inc. Increases Their Dividend by 5%

Dividend Paying Stocks That Investors Have Been Buying

Updates From the DGI Community – July 2019

Monthly Update Report from July 2019

Recent Dividend Stock Buys By The DGI Bloggers

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

What an interesting month that it has been. I was able to get in some work and some play. Plus I was able to start a new position in Johnson & Johnson. Despite their hardships right now, I believe that it will be a great company to own for a lifetime.

The portfolio has continued to perform very well. I am absolutely loving the accumulation stage of my investing career. Granted, I still don’t have a large portfolio but it has been very pleasing to watch it slowly grow over time. Not only has the portfolio grown but so have I. My investing knowledge has expanded vastly compared to 5 years ago when I first started on this journey. The way in which I analyze companies have changed a large amount since then too.

Since I began, I have tested several different strategies. Some of them I decided didn’t work very well and others I am still using to this day. I have also started employing some techniques that I haven’t even mentioned on the blog yet.

Needless to say, I am feeling very excited about where I am at and even more excited about where I am headed.

You have heard about what has been going on here lately! Leave me a comment down below and let me know how your portfolio performed during the month of August.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

That’s an impressive growth in August compared to last years.

Thanks DivforLife. Growth has definitely slowed down for me in August but the portfolio is doing a lot of the heavy lifting for me now.

Looks like a pretty good month MD! A little bit of play time, solid dividend growth year over year and one of the most widely owned dividend growth companies around being added to your portfolio. JNJ has been great for me and I think now is a decent time to add shares. I don’t think it’s extremely undervalued using just a quick scan, but I think it’s at least in the fair value range which is good enough for that high quality of a company.

JC recently posted…Church & Dwight: Caution Is Warranted At These Levels