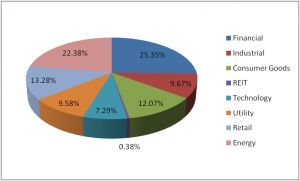

More Dividends Portfolio Allocation

Recently, I was reading an article titled Dividend Portfolio Sector Allocation June 2016. It made me realize that while I do look at allocation of each stock in my portfolio, I haven’t really kept up with how the allocations apply to the different sectors. So I decided that this was a metric that I needed to start including in my monthly updates….. why am I doing one right now you may be asking…. that way I can test out how I present the information. Like everything else in life this blog is constantly changing and evolving. Now let me go ahead and get into point of this article.

I have made only a couple of changes to my holdings since I started investing, so this will be pretty much how it has been since the start. I like to always try and think through my investments by studying the fundamentals and looking at micro and macro economics factors that could affect my investment. One thing that stands true though is that I always try and make investments that I can hold over the long term, so that I can maximize my gain from the investment. Another element that I try and apply is a good diverse allocation of my investments. So lets take a look at how my investments break down by sector.

Now as I look at this graph I realize how heavy my allocation has become in Financials and Energy. Although I am a bit heavy in these two sectors, I’m still not going to run out and sell some stock just to have a more even allocation. I bought into Financials and Energy at what I consider to be good times, their value will continue to appreciate moving forward so I want to leave them just like they are for now.

Something that really affects my allocation is the fact that my portfolio is not very large at the current moment. As dividends are reinvested and fresh capital is invested it will be harder to affect the allocation scale so much. Some of the companies that I am looking at putting some money into operate in other sectors so that will help even out my allocation by sector some.

As I stated at the start of this article… moving forward I will be including this portfolio allocation chart in my monthly updates so that I can stay aware of how my money is being allocated. I also want to say thanks to DivHut for posting the article that inspired this. I am interested in hearing what you all think of my current allocation by sector. Please leave your comments or questions below!

Healthy exercise to look and review your portfolio on a regular basis. Quite frankly, I need to get better at it myself. Don’t worry about your heavy allocations in Finance and Energy, that will come down over time as you continue to add to new sectors. That being said, if you are looking for further diversification, I think you should lay off on buying any new stocks in those specific sectors. Just my two cents!

Have a great weekend.

Bert, One of the Dividend Diplomats

I totally agree with you Bert. I have no plans to add anymore to these sectors right now…. unless there is a big pullback and I can strengthen some of my existing positions. I know with my portfolio being small right now that small changes in it can make big effects to the allocation, as I grow the portfolio this will be less of a problem. I am currently watching some stocks in other sectors to help even out my allocation some and to keep me diversified.

I hope you have a good weekend too. Thanks for stopping by, I appreciate your feedback!