More Dividends Update from December 2022

December was great but man a I glad that the holidays are over. The holidays are great for spending time with loved ones. Sometimes in smaller batches than others. Unfortunately, another part of the holidays is not quite so enjoyable.

First off, you have all of the additional expenses of buying everyone presents. The dollar amount adds up quickly especially if you factor in all of the time that is spent doing this. Another expense that I incurred during the holidays were travel expenses. Luckily for me all of my travel was pretty local so it wasn’t to expensive. For some another big holiday expense can be in food for the holiday gatherings.

Despite all of these cons, the pros of spending time with loved ones is always more valuable to me. Of course, that is to say that I am quite often relieved once the holidays are over because then we transition into a new year.

With the new year comes all kinds of exciting adventures. For one, I get to start planning and booking my trips that I am looking forward to taking during the year. Plus, I get to sit down and work on my goals sheet for the coming new year and I get to start allocating money into different accounts.

While some people may look at some of these task as torturous, I look upon them very favorably because it helps me get excited for the new year that I am moving into.

Like most people, I am very excited to see what the next year holds for me. I am always up for an adventure and believe that life is the purist form of art.

Regardless, of my excitement for the new year, I must first take a moment to look back at December to see how well that we closed the year out.

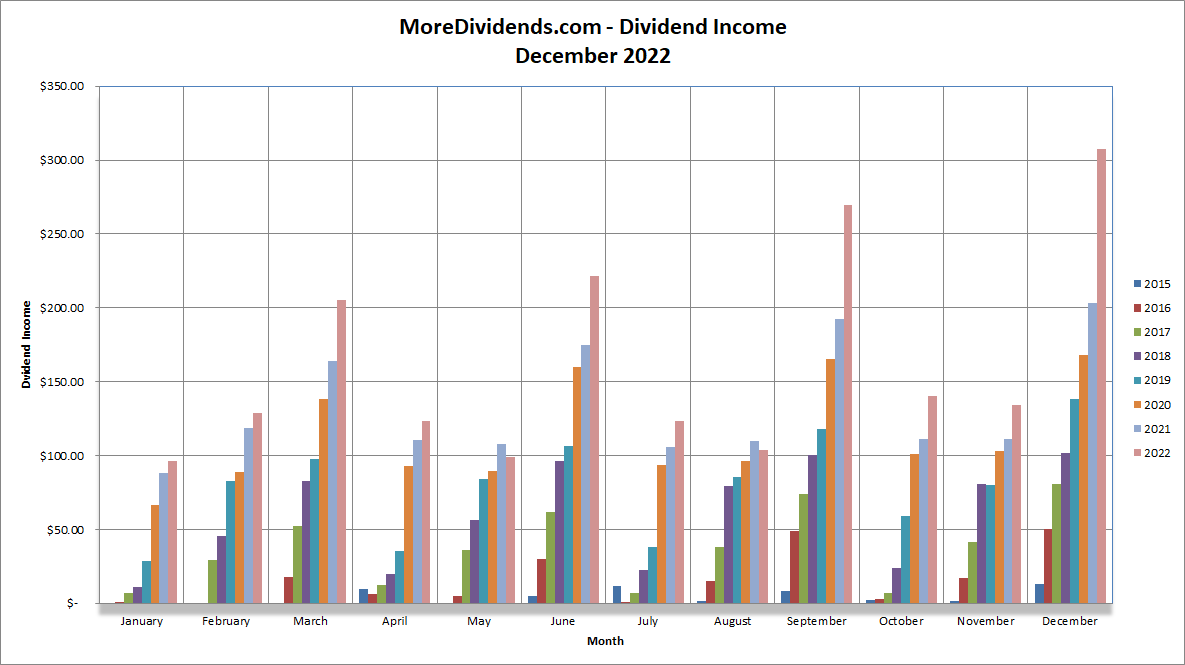

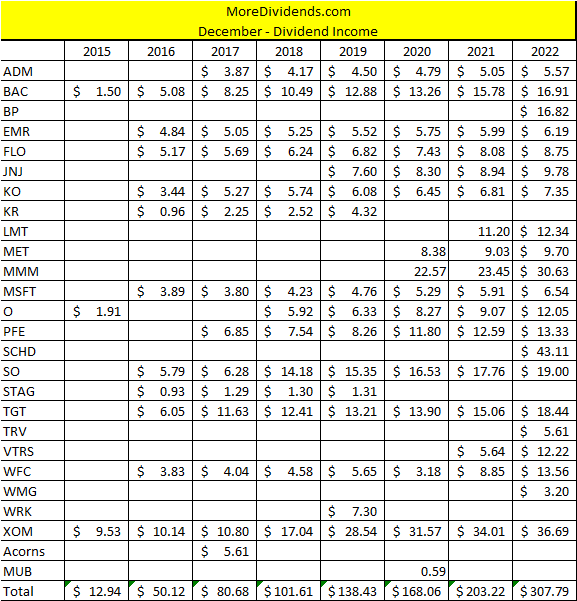

Let’s take a look at the dividend income that was received during the month of December.

Archer Daniel Midland (ADM) – $5.57 – Reinvested

Bank of America (BAC) – $16.91 – Reinvested

BP (BP) – $16.82 – Reinvested

Emerson Electric (EMR) – $6.19 – Reinvested

Flowers Foods (FLO) – $8.75 – Reinvested

Johnson & Johnson (JNJ) – $9.78 – Reinvested

Coca Cola (KO) – $7.35 – Reinvested

Lockheed Martin (LMT) – $12.34 – Reinvested

Metlife (MET) – $9.70 – Reinvested

3M (MMM) – $30.63 – Reinvested

Microsoft (MSFT) – $6.54- Reinvested

Realty Income (O) – $12.05 – Reinvested

Pfizer (PF) – $13.33 – Reinvested

Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF(SCHD) – $43.11 – Reinvested

Southern Company (SO) – $19.00 – Reinvested

Target (TGT) – $18.44 – Reinvested

Viatris (VTRS) – $12.22 – Reinvested

Wells Fargo (WFC) – $13.56 – Reinvested

Warner Music Group (WMG) – $3.20 – Reinvested

Exxon Mobil (XOM) – $36.69 – Reinvested

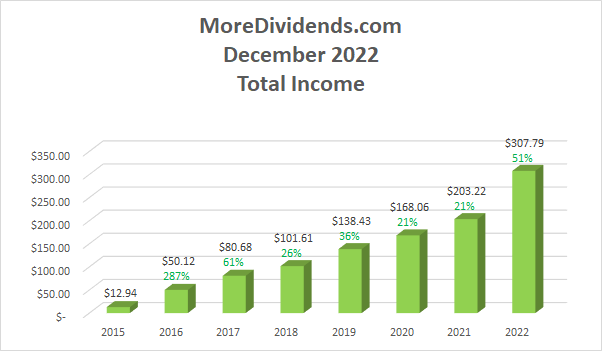

December was the last month of Q4 and accounted for $307.79 of my 2022 Dividend Income.

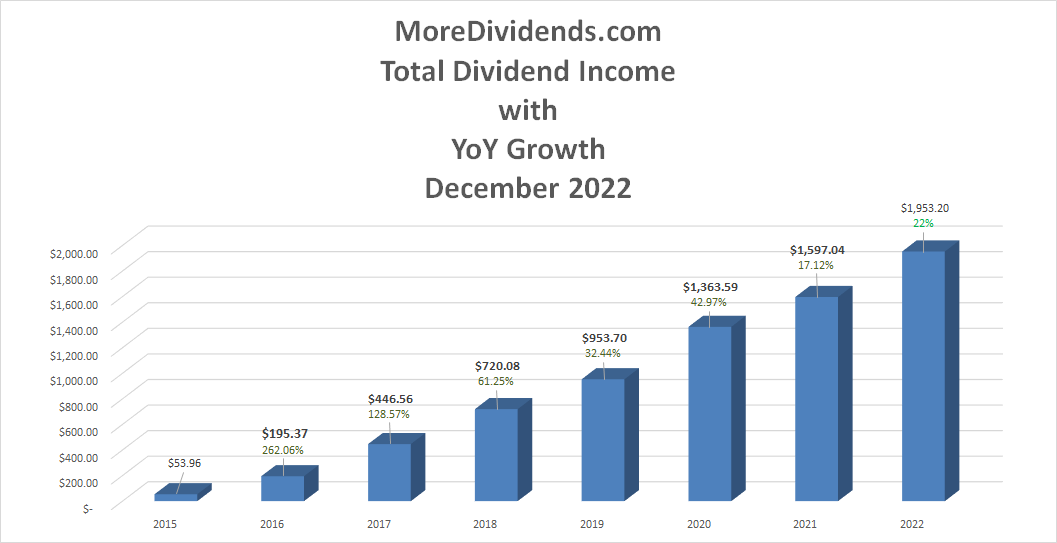

In total during 2022, I earned $1,953.20 in dividend income.

With December closing out the end of the 2022 season, I could not be more excited about the future. 2022 has been my biggest earning year for dividend income. I continue to let this money compound while I keep looking for new opportunities to invest my money into.

So far my dividends received looks like this

Dividends Received By Year

December proved to be a phenomenal month. It was my highest earning month as of yet. It was also the first time that I earned $300 in a single month.

This was great because that means that $300 was invested into more stock without me having to do anything. The portfolio has reached a point where it is starting to do a lot of the heavy lifting for me. So I am very excited to see how much growth will be created over the next year.

Let’s take a look at how things stack up on a year over year basis for the month of December.

Stock Additions

During the month of December there were several additions made to the More Dividends portfolio. I will be publishing a new Recent Buy article detailing my investment thesis on these additions.

Viatris (VTRS) – 26 shares

WestRock (WRK) – 30 shares

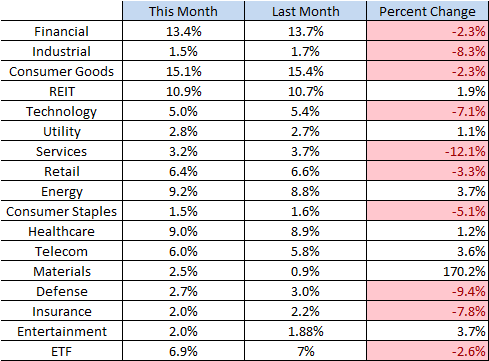

Portfolio Allocation

This month I will be presenting a new bit of information when it comes to the portfolio allocation. I will be showing the way the allocation looks in the current month, the previous month as well as the percent change.

I like this presentation because it will be easier to see how the allocation is truly shifting on a monthly basis. Please let me know in the comments what you think of this.

What this new bit of information does clearly show me is that I had a huge shift to the Material sector and this is mainly due to the addition of all of the WestRock stock.

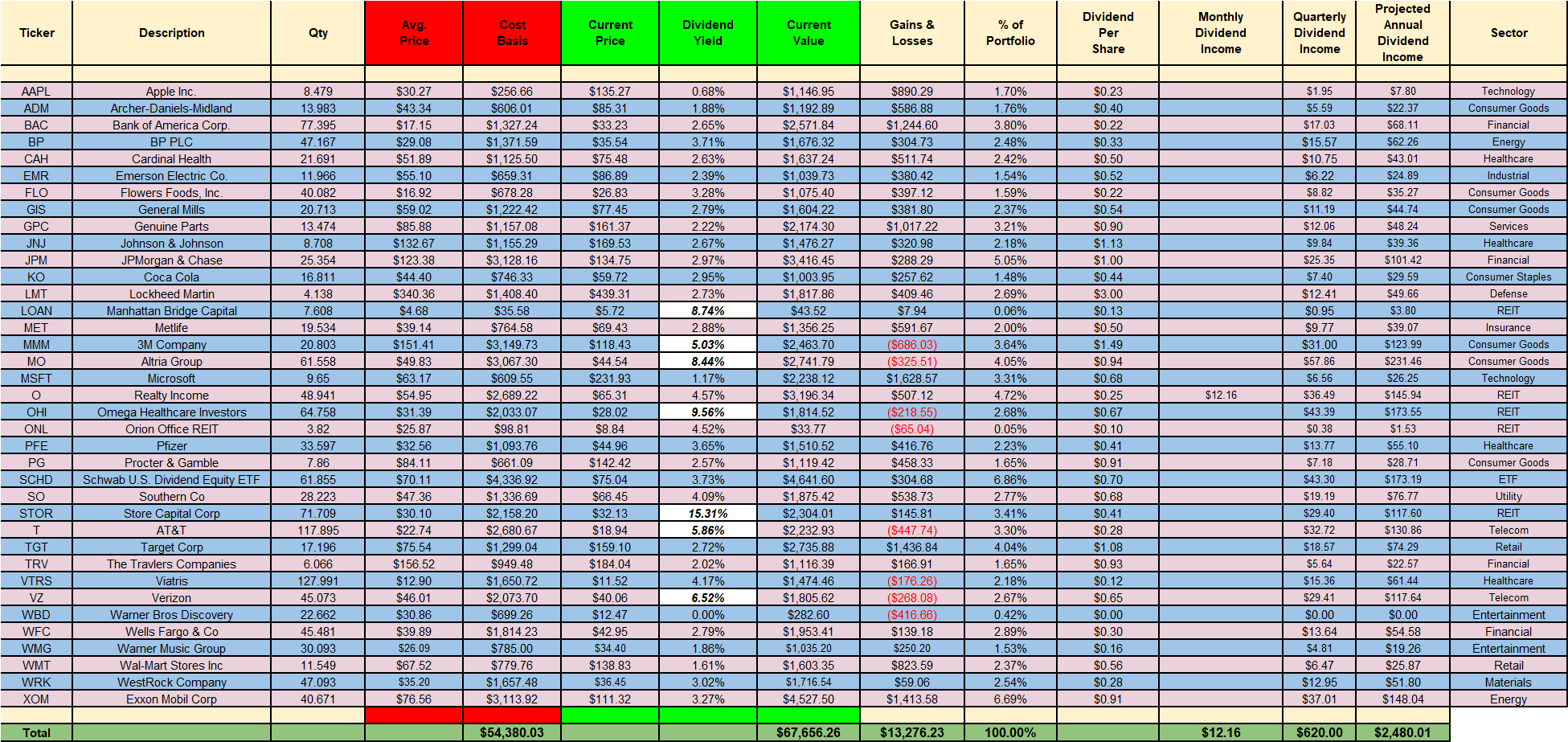

Current Portfolio

I am very pleased with the current standing of the portfolio. I have been making additions as I see fit which has been helping fuel the growth along with the reinvested dividends.

The portfolio will definitely be reaping the benefits of those additions in the near future.

I will continue to tuck money away into Worthy Bonds until I find a better position for the capital. If you know me, then you will know that I love to have my money working for me.

MoreDividends.com Articles

Here are the 4 articles that I posted on MoreDividends.com during December from oldest to newest.

More Dividends Update from November 2022

Pfizer Increases Their Dividend by 2.5% in 2022

Realty Income Increases Their Dividend by 0.2% One More Time in 2022

Recent Buy – WestRock ( $WRK )

December saw some new articles on the blog. In the future, look for a more diverse range of articles coming to the blog.

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

December was a great month. Good decisions will continue to fuel the More Dividends machine. I’m looking forward to growing the portfolio in the future.

With constant contributions and reinvesting dividends the portfolio should continue to see some great growth.

I will keep working, keep investing, keep building, keep living, and keep adventuring!!!

As always I look forward to reading all of your comments and questions, until then….. happy investing!!!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

Facebook: MoreDividendsdotcom

Twitter @MoreDividends

Instagram HikingInGeorgiadotCom

Tik Tok Hiking.In.Georgia

If you would like to receive an email whenever I publish a new article:

That’s a very strong showing for the month of December. Congrats on almost hitting that $2k mark. As usual, a lot of common names paying us both last month. I hold BP and it’s rare to see it in other portfolios. Like you I also like to plan future yearly trips in the beginning of the year. Once you decide where to go and book it you have something to look forward to. I do the same with my family. Keep on buying and reinvesting. Here’s to a good ’23!

DivHut recently posted…Recent Stock Purchase January 2023

This is very true DH. I hope that things have been going well for you! I think we have narrowed in on some ideas for our next trips. Now it’s time to sit down and to start doing the planning! Any idea where you will take your next trip? Thank you for the kind words. Same to you. I look forward to seeing what 2023 has in store for both of us!

I’d like to visit the gulf coast of USA. West FL, AL, MS

DivHut recently posted…Recent Stock Purchase January 2023