More Dividends Update from November 2022

November proved to be a very relaxing and chill month for me. I knew when I made it home from my Costa Rica trip that there would be a small relaxing period that would happen before things started kicking into high gear for the holidays.

Well, I can confirm that this was in fact exactly how it happened.

After returning home, naturally I resumed work at my normal job. A normal work week for me consists of working 10 hours a day Monday through Friday and then working Saturday until around lunch time. Which is fine with me because it allows me to earn more money each week, without feeling like it is really taking from my personal time. We all know that the more we earn, the more that we can invest. So I am ok with earning more while I am still fairly young and can do it.

Along with getting back into the normal routine of work, I also began to work on my forever growing To-do list that I had kind of been neglecting in the weeks leading up to my trip. The task were not hard task, just a bunch of errand style task. So I set out to work on eliminating some of these task from my list during my off time from work.

I bet this seems like a lot considering the fact that I said that this was a relaxing time. Trust me, I only do things that I enjoy so while it may have been a bit cumbersome, it was never very stressful.

Along with all of these task, I also set out to organize my pictures and videos from the trip so that I could begin to publish them on my Instagram. Look for a large influx of new content to be published there.

Now, if all of that was not enough, I also was able to find some time to do some research and to add some new stocks to the portfolio. I was also able to begin the adoption of some of my new investment strategies which I will talk about later on in this article.

Life is an adventure and I love to keep it interesting.

Let’s take a look at the dividend income that was received during the month of November.

Apple (APPL) – $1.26 – Reinvested

General Mills (GIS) – $11.11 – Reinvested

Realty Income (O) – $12.00 – Reinvested

Omega Healthcare Investors (OHI) – $42.50 – Reinvested

Procter & Gamble (PG) – $7.13 – Reinvested

AT&T (T) – $26.76 – Reinvested

Verizon (VZ) – $28.91 – Reinvested

WestRock (WRK) – $4.67 – Reinvested

November was the second month of Q4 and accounted for $134.34 of my 2022 Dividend Income.

In total during 2022, I have earned $1,645.41 in dividend income of a projected $1,951.58!

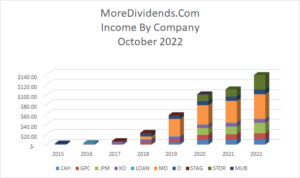

This will be my highest earning year for dividend income and it only makes me even more excited for the future. I will continue to let the dividends compound over time! I would love to be able to see the same kind of growth that I have seen in previous years. Only time will tell if I can continue with such high double digit growth.

So far my dividends received looks like this

Dividends Received By Year

November or any second month of the quarter has never been a huge earner for me. I would say that a large percentage of the companies will pay their dividend during the last month of the quarter. I have never paid a whole lot of attention on when a company pay’s their dividend. It has always been more important to me that I invested in solid companies.

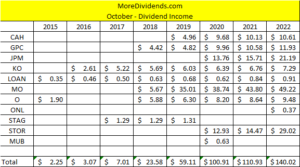

Let’s take a look at how things stack up on a year over year basis.

Stock Additions

During the month of November, I did make a small addition to my newest position in Warner Music Group. Read the recent purchase article for more information on my investment thesis. It was a small addition of 10 more shares and it added $6.40 to my projected annual dividend income.

I am still looking for good investment ideas while also keeping in mind that we will be heading more into a recession in the months to come in the future.

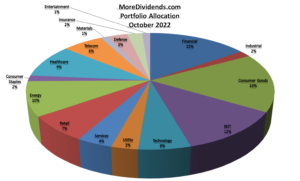

Portfolio Allocation

There wasn’t much movement in the portfolio allocation, even with the recent addition of Warner Music Group. Bigger shifts happened because of market flucuations.

I am pleased with the current allocation and will continue to look for new investments.

Lets take a look at how my current portfolio is allocated.

Financial – 13.7%

Industrial – 1.7%

Consumer Goods – 15.4%

REIT – 10.7%

Technology – 5.4%

Utility – 2.7%

Services – 3.7%

Retail – 6.6%

Energy – 8.8%

Consumer Staples – 1.6%

Healthcare – 8.9%

Telecom – 5.8%

Materials – 0.9%

Defense – 3.0%

Insurance – 2.2%

Entertainment – 1.88%

ETF – 7%

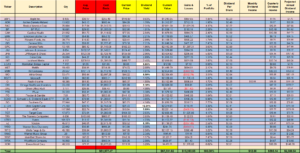

Current Portfolio

I am very pleased with the current standing of the portfolio. I have spent some time making sure that the portfolio is well diversified, not just by sector but by investment vehicle as well.

The near future is very uncertain. The interest rates are super high, the real estate market is super high. So, I wanted to stash some money into some other investment types. So I have begun buying small amounts of Worthy Bonds ever week. They offer a 5% interest on the bonds so I like the idea of earning a higher interest rate than I am getting in either my high yield savings or money market account.

I will continue to tuck money away into Worthy Bonds until I find a better position for the capital.

MoreDividends.com Articles

Here are the 4 articles that I posted on MoreDividends.com during November from oldest to newest.

Emerson Electric Increases Their Dividend by 1% in 2022

A few things that I like to do for fun!

More Dividends Update from October 2022

Recent Buy – Warner Music Group ( $WMG )

It felt great to jump back into the habit of regular writing so that I can publish more articles but I am going to work hard so moving forward expect to see a more consistent stream of articles published on the site. I would love to hear about what kind of articles that you would like to see more of here on the site.

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

There we have it. We added to our newest position in Warner Music Group, we started adding some Worthy Bonds to our portfolio and things are looking great. I am looking forward to the rest of the holiday season. I am hoping to be able to start work on planning some of my future trips as well ax taking some more local hikes.

I will keep working, keep investing, keep building, keep living, and keep adventuring!!!

As always I look forward to reading all of your comments and questions, until then….. happy investing!!!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

Facebook: MoreDividendsdotcom

Twitter @MoreDividends

Instagram HikingInGeorgiadotCom

Tik Tok Hiking.In.Georgia

If you would like to receive an email whenever I publish a new article:

I was just thinking last night about possibly adding some short term bond funds to my portfolio that is currently largely in cash, my HSA. I’ve been slowly funneling some of the funds towards ETFs but the yield is anemic on the cash. Looks like a great November for your dividends and I’m sure that Costa Rica trip was awesome.

JC recently posted…A. O. Smith: As The Share Price Cools, The Stocks’ Attractiveness Heats Up $AOS