More Dividends Update from October 2019

August turned out to be a pretty good month for More Dividends! I saw a lot of growth organically in the portfolio. Plus I was able to make some new additions to the portfolio. I am excited to see what the future holds for the portfolio because I am truly enjoying the journey that it has taken me on so far. I continue to look for good opportunities to either start new positions or strengthen some existing positions.

Stock Additions

The month of October brought a very interesting change. During the month, my broker decided to start offering $0 trade commission fees. So I have started to make smaller purchases of stocks. This month, I was able to add small amounts to some of my existing positions.

Cardinal Health (CAH) – 5 shares

Johnson & Johnson (JNJ) – 3 shares

ExxonMobil (XOM) – 4 shares

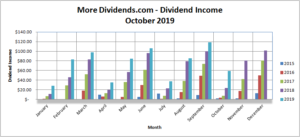

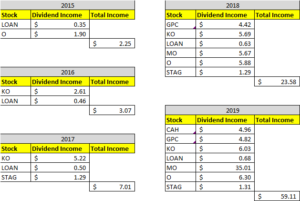

Dividends Received

This month provided me with a new 1st month of the quarter high record. I saw a 56% growth in quarter over quarter comparison.

Cardinal Health (CAH) – $4.96 – Reinvested

Genuine Parts (GPC) – $4.82 – Reinvested

Coca Cola (KO) – $6.03 – Reinvested

Manhattan Bridge Capital (LOAN) – $.68 – Reinvested

Altria Group (MO) – $35.01 – Reinvested

Realty Income (O) – $6.30 – Reinvested

STAG Industrial (STAG) – $1.31

October was the first month of Q4 and accounted for $59.11 of my 2019 Dividend Income.

In total during 2019, I have earned $735.35 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 150% increase in dividends earned during the month of October. Some additions have occurred which have affected this year over year growth.

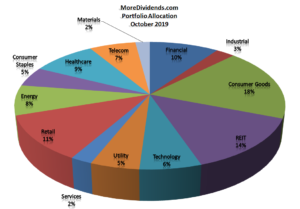

Portfolio Allocation

The small additions to the portfolio didn’t make a large impact to the asset allocation! Overall, the allocation is still well diversified.

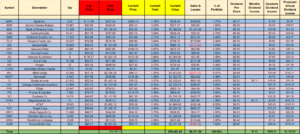

Current Portfolio

The portfolio has been on a big rally the past few months. Plus my recent additions to the portfolio has helped build propelled the portfolio value to over $30K. I am really starting to see the effects of the compounding. I will continue to make well calculated buys but it is seeming a bit harder while the markets are reaching all time highs.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during October from oldest to newest.

More Dividends Update from September 2019

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

My first month of the quarter has really started to blossom. It has made a huge leap since last quarter and I look forward to seeing how much of a leap that it can make before January!

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Congrats on a solid October Jason! My broker also moved to $0 commissions so I’ve been enjoying getting to DCA into some positions that I really want to build up. I’ll gladly take the slow and steady approach.

JC recently posted…Dividend Update – October 2019

Excellent progress, Jason, as evidenced by that YoY growth. I bought some XOM recently, too.

I see MO delivered the majority of this month’s income for you. I see MO topping many income lists thanks to their high yield.

You have some good diversification going in your portfolio… keep it up.

Engineering Dividends recently posted…Recent Transactions – CTSH, SBUX, XOM, CSCO, MMM

Thanks for the kind words of encouragement ED. I hope that all has been going well for you. It has been a slow climb so far but it is really starting to pick up traction now. I am more excited about my portfolio now than I have ever been.