More Dividends Update from August 2018

Welcome back readers. I hope your travels have been going well over the past few months. I know that I recently have returned from a nice getaway to Charleston, South Carolina. It’s a beautiful place that I would recommend to anyone!

August proved be a test for the passive nature of a good dividend investing strategy. The month proved to be very busy for me which left my portfolio running in autopilot. Fortunately for me, I am confident in my choices so I slept very good at night.

It is reassuring to know that when I get too busy my portfolio will continue to work for me. So let’s take a look at how the portfolio did during the month of August.

Stock Additions

With my mind focused on my recent vacation, it left little time to focus on the portfolio. So there were no purchases made during the month of August but I am currently looking for some good opportunities. So let me know what companies you have been looking at lately!

Dividends Received

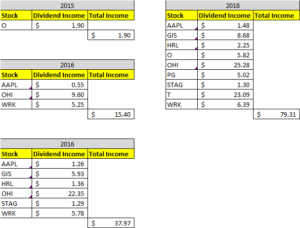

My second month of the quarter has continued to grow amazingly. If it continues to grow at this rate they will soon begin to be the months with the most income. Let’s see where our income comes from this month.

Apple (APPL) – $1.48 – Reinvested

General Mills (GIS) – $8.68 – Reinvested

Hormel (HRL) – $2.25

Realty Income (O) – $5.82 – Reinvested

Omega Healthcare Investors (OHI) – $25.28 – Reinvested

Procter & Gamble (PG) – $5.02

STAG Industrial (STAG) – $1.30

AT&T (T) – $23.09 – Reinvested

WestRock (WRK) – $6.39 – Reinvested

August was the second month of Q3 and accounted for $79.31 of my 2018 Dividend Income.

In total during 2018, I have earned $413.87 in dividend income!

That is 41.4% of my 2018 goal.

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 108.9% increase in dividends earned during the month of August. Like a lot of months, my additions have helped fuel the growth year over year. This trend will probably continue until I get my positions built up enough so that the reinvested dividends can start doing some of the work. Let’s take a look at the year over year comparison.

Portfolio Allocation

We all ready know the situation here. With no new additions to the portfolio we can assume that all changes in allocation are only due to market fluctuations. So let’s take a look at what the current portfolio allocation looks like.

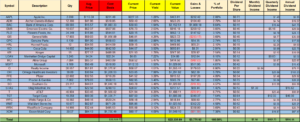

Current Portfolio

The market has seen a bit of a rise lately and so has my portfolio. I am still comfortable with everything in the portfolio right now. So I will continue to hold and to look for new oppuritunites to put some new money to work. Let’s take a look at the current portfolio.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during August from oldest to newest.

Recent Buys from DGI Bloggers – Week of 7/30/2018

More Dividends Update from July 2018

Recent Buys from DGI Bloggers – Week of 8/6/2018

Recent Buys from DGI Bloggers – Week of 8/13/2018

Why Go For Dividend Investing?

Recent Buys from DGI Bloggers – Week of 8/20/2018

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Its nice to know that the More Dividends portfolio will continue working even when I get busy. This month proved to validate the theory behind dividend investing. I intend to be more active in the coming months as the summer months wind down.

I am really looking forward to see what the next couple of months have in store for the market and hopefully I will be able to find some great opportunities to buy more stock.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever a new article is published on More Dividends just enter in your information below!

Great performance to have welll over 100% growth in dividend income compared to August 2017!

I appreciate that. Hopefully I will be able to continue that kind of growth. Thanks for stopping by IWD.