More Dividends Update from October 2022

Well hey there. IT has been way to long since I have published a monthly update. The last time was back in March of this year. There has been a lot going on since then but we will get to that in a minute. Let me take a minute to see how all of you have been, please leave me a comment down below and let me know how you have been doing. I would love to hear about it.

Hopefully everyone has been doing well. I have been doing good, since my last monthly update I have been keeping myself very busy with some work and a hole lot of play. I have working on developing another site called HikingInGeorgia.com. On that site, I have been chronicling hikes that I have went on in Georgia. It is my home state so I do a lot of my hiking within just a few hours of where I live. Along with the site it also has supporting accounts on Twitter and Tik Tok. I definitely recommend you follow those accounts if you have any interest in hiking or photography.

Along with launching that project, I also recently returned from traveling abroad. I took a few weeks on enjoyed the Pura Vida lifestyle down in Coasta Rica. While visiting there I drove for over 800 miles while staying in 4 different cities. All of those cities were Montezuma, Monteverde, La Fortuna and Uvita, If you are looking for a great VRBO host to stay with please let me know! While in Coasta Rica it was actioned packed while we hiked in the rain forest, climbed up Cerra Chato Volcano, swam in the beautiful Nauyacah Waterfall and even ziplined above the forest of Arenal Volcano. Don’t worry though, look for documentation of my travels to show up on a social media platform to you soon in the form of photos and videos.

As of right now, I have a confession to make. Not only have I been working on a new project and traveling to other countries but I also freed up a lot of capital back earlier in the year so I have been strategically adding to my portfolio during the past few months. I am looking forward to getting back into the habit of sharing my investment ideas and stock analysis with you guys along with updates on my investing journey as well!

Not only do I talk the talk but I also like to walk the walk so lets take a look at the newest edition of the monthly update from October 2022.

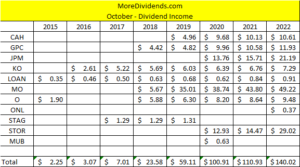

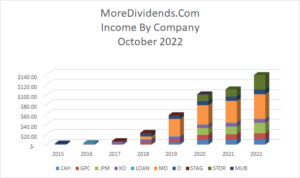

Dividends Received

October is the first month of the quarter. So it has never been a huge earner for me but the income has been increasing at a larger rate the past couple of years. I have never picked which stocks to invest in based on when the dividend was paid. I have always just invested in what I thought were good deals and I let the dividend income fall where ever it may.

The reason the growth during this month would have to be because of the larger positions in JP Morgan Chase, Altria Group and Store Capital. Unfortunately, if you have been following the news then you will know that it is in the works to turn Store Capital into a private company so when that happens I will be bought out but I will be losing the dividend income.

Needless to say, it will be interesting to see how this turns out in the future but until then lets take a look at how it performed last month,

Cardinal Health (CAH) – $10.61 – Reinvested

Genuine Parts (GPC) – $11.93 – Reinvested

JP Morgan Chase (JPM) – $21.19 – Reinvested

Coca Cola (KO) – $7.29 – Reinvested

Manhattan Bridge Capital (LOAN) – $.91 – Reinvested

Altria Group (MO) – $49.22 – Reinvested

Realty Income (O) – $9.48 – Reinvested

Orion Office REIT (ONL) – $0.37 – Reinvested

Store Capital (STOR) – $29.02

October was the first month of Q4 and accounted for $140.02 of my 2022 Dividend Income.

In total during 2022, I have earned $1,511.07 in dividend income of a projected $1,918.78!

This will be my highest earning year for dividend income and it only makes me even more excited for the future.

So far my dividends received looks like this

Dividends Received By Year

October or any first month of the quarter has never been a huge earner for me. Somehow though all these years later October is still producing a 26% year over year growth in dividend income.

This is great to see because as we all know that more dividend income means more money reinvested into more dividend paying stocks. The larger the snowball the more freedom that I can have to pursue some of my other interest in life.

Let’s take a look at how things stack up on a year over year basis.

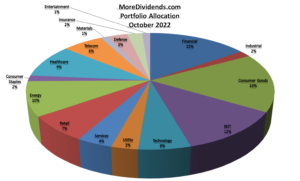

Portfolio Allocation

By far, I would say that this chart has changed the most. During my time away, I have started several new positions and those investments operate in new sectors for my portfolio. The largest of these new positions would be the fact that I have added SCHD, which is an ETF, to my portfolio. That one position along now holds 7% of the total portfolio. Along with the inclusion of ETFs, we can also see that I have some new positions in the Entertainment sector.

Overall, I am still pretty pleased with my portfolio allocation. I don’t believe that I am overweight in any one sector. This is something that I will continue to keep an eye on as it is very important to keep a well diversified portfolio.

Lets take a look at how my current portfolio is allocated.

Financial – 14.3%

Industrial – 1.7%

Consumer Goods – 15.2%

REIT – 11.2%

Technology – 5.3%

Utility – 2.7%

Services – 3.6%

Retail – 6.6%

Energy – 8.9%

Consumer Staples – 1.5%

Healthcare – 8.8%

Telecom – 5.9%

Materials – 0.9%

Defense – 3.0%

Insurance – 2.2%

Entertainment – 1.17%

ETF – 7%

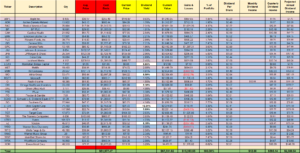

Current Portfolio

The current portfolio is doing fantastic. I have added a lot of new capital to the portfolio as well as having a nice position of cash just waiting to be deployed. I am not in a rush to deploy this capital since I believe that we are currently in a bear rally and that the overall market will still have to go through some pain before we get back to a bull rally.

Until that time, I will continue adding more capital to the coffers as well as investing in what I consider good buying opportunities that seem to make since for my portfolio.

MoreDividends.com Articles

Here are the 2 articles that I posted on MoreDividends.com during October from oldest to newest.

WestRock Increases Their Dividend by 10% in 2022

Exxon Mobil Increases Their Dividend by 3.4% in 2022

Both of the articles published on the site reflected dividend increases that happened in the portfolio. Moving forward expect to see a more consistent stream of articles published on MoreDividends.com

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

With less than 2 months to go, 2022 has proven to be an amazing year. A lot of new projects and a lot of new adventures. That coupled with a growing stream of dividend income has helped contribute to this fantastic year.

Time away has helped me clear my mind and re-center so I am looking forward to producing more for More Dividends in the future!

At almost 8 years old, I am excited to see this site grow as it approaches and then surpasses the 10 year mark

As always I look forward to reading all of your comments and questions, until then….. happy investing!!!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

Facebook: MoreDividendsdotcom

Twitter @MoreDividends

Instagram HikingInGeorgiadotCom

Tik Tok Hiking.In.Georgia

If you would like to receive an email whenever I publish a new article:

Bet that trip was awesome! We haven’t done much travelling recently but in early October we did get to go to this lake house a few hours away that we really enjoy. Private lake, small boats/canoes, hiking, fire pit…it’s so great when we get a chance to go out there.

Looks like some fine work on the dividend front for you too and you should easily surpass last years total and potentially hit $2k in projected income by the end of the year.

JC recently posted…Dividend Increase | EOG Resources $EOG #Dividend