More Dividends Update from March 2019

Welcome back readers. I greatly appreciate you guys sticking with me considering how idle the blog has been the past few months. Look for this to change very soon. I have some very interesting things in the works that I will be rolling out in the coming months.

During the month of March, the portfolio was still working on auto pilot. So there isn’t a lot to report. I received and reinvested the dividends. That’s it. The update is over…..

Just joking. Let’s look at just how well my portfolio runs on autopilot.

Stock Additions

No new additions during March.

Dividends Received

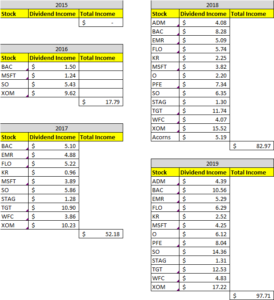

It wasn’t a record month but I am still very happy with the performance for the month.

Archer Daniel Midland (ADM) – $4.39 – Reinvested

Bank of America (BAC) – $10.56 – Reinvested

Emerson Electric (EMR) – $5.29 – Reinvested

Flowers Foods (FLO) – $6.29 – Reinvested

Kroger (KR) – $2.52

Microsoft (MSFT) – $4.25 – Reinvested

Realty Income (O) – $6.12 – Reinvested

Pfizer (PF) – $8.04 – Reinvested

Southern Company (SO) – $14.36 – Reinvested

Stag Industrial (STAG) – $1.31

Target (TGT) – $12.53 – Reinvested

Wells Fargo (WFC) – $4.83 – Reinvested

Exxon Mobil (XOM) – $17.22 – Reinvested

March was the last month of Q1 and accounted for $97.71 of my 2019 Dividend Income.

In total during 2019, I earned $209.02 in dividend income!

So far my dividends received looks like this

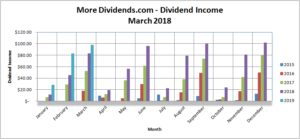

Dividends Received By Year

Year over year, I saw an 18% increase in dividends earned during the month of March. Let’s take a look at the year over year comparison.

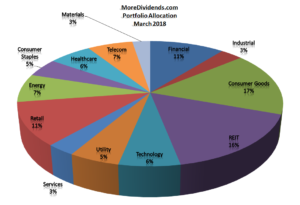

Portfolio Allocation

Small changes in allocation because of the market but none significant enough to be concerned about at this point.

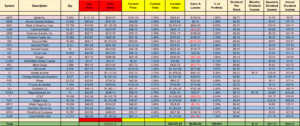

Current Portfolio

Reinvested dividends and the market have driven the changes in my portfolio. I am very excited with how it is doing right now. Let’s take a look.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during March from oldest to newest.

0.2% Dividend Increase from Realty Income (O)

More Dividends Update from February 20198

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

March will be the end of the autopilot. I will be more active moving forward.

The reinvested dividends are very nice but I will be infusing more capital into the portfolio. I have been very please how well the portfolio has done while on autopilot. The past few months has really shown me that I am working a good strategy because the portfolio continued to compound even when I was off doing other things in life.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever a new article is published on More Dividends just enter in your information below!

Congrats. Your report shows the beauty of passive income from dividend investing. It is inspiring.

DSFI recently posted…Dividend Income | March 2019 | $7.29

Congrats on a great month! 18% YOY growth is awesome! Keep it up!

My Dividend Dynasty recently posted…March 2019 Dividend Income – The $1K Milestone

Good stuff, the nice thing about no new additional acquisitions YOY is you can directly compare and difinitively see the effects of DRIP and dividend growth.

I’m late to the punch but look forward to seeing your April update. Enjoying reading up on everyone’s blogs since starting my own. I’ll be following your journey for sure!

-Brent