More Dividends Update from August 2020

Killing it in August! The dividends just keep rolling in while I look for my next move to strengthen the portfolio.

Life has seemed very busy lately. I am going through a phase of overtime at work so I have been using this opportunity to pay down some debt. While at the same time I have begun taking an online class for electronics which should help increase my yearly salary.

Always keep it moving forward! That’s the name of the game. I am going to keep pushing to better my position in life as I strive for financial independence.

Look for a series of new articles to be published very soon.

Until then lets take a look at how the portfolio performed during August.

Stock Additions

I am going to mention a pseudo stock addition. Because of the recent stock split from Apple my share count went up. While this does look like an addition it doesn’t actually affect my cost basis.

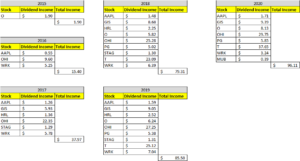

Dividends Received

I am a true supporter of the belief that the road to wealth is built on compounding interest. This is why I elect to have all of my dividends reinvested back into the company. Overtime, the income stream has continued to grow and will only grow larger as time goes on.

This month I received dividends from 8 different companies.

Let’s take a look at those companies!

Apple (APPL) – $1.71 – Reinvested

General Mills (GIS) – $9.39 – Reinvested

Realty Income (O) – $8.13 – Reinvested

Omega Healthcare Investors (OHI) – $29.75 – Reinvested

Procter & Gamble (PG) – $5.85 – Reinvested

AT&T (T) – $37.65 – Reinvested

WestRock (WRK) – $3.24 – Reinvested

iShares National Muni Bond ETF (MUB) – $0.39 – Reinvested

August was the second month of Q3 and accounted for $96.11 of my 2020 Dividend Income.

In total as of August during 2020, I earned $ $826.60 in dividend income!

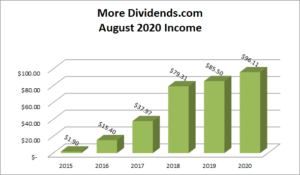

Dividends Received By Year

As the following graphs will show, August has seen moderate growth over the past couple of years. The last time the growth really popped in August was back in 2018 when I first received my AT&T dividend. I would love to see some more growth created but I’m not willing to chase a stock based on when it’s dividend is paid.

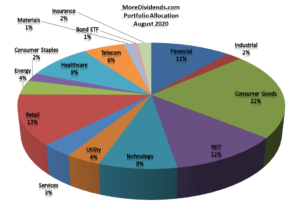

Portfolio Allocation

For the most part, there hasn’t been no major shifts in the portfolio allocation in years. Market fluctuations will make small changes and stock additions will affect it as well. This phenom is created simply by the facct that I don’t normally sell stock.

I would be very curious to know what you think of my current portfolio allocation!

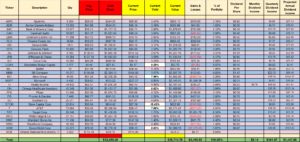

Current Portfolio

The portfolio just continues to grow. As I have matured as an investor I have continued to grow my net worth by diversifying my investments into other areas. Despite that, deep down I will all first and foremost identify as being a dividend investor.

I am proud of how well the current portfolio is looking and I am looking forward to watching it grow larger!

MoreDividends.com Articles

Here are the 3 articles that I posted on MoreDividends.com since the last monthly update from oldest to newest.

Why budgeting is important during COVID-19 and how to do it?

Altria Group Increases Their Dividend by 2.4% in 2020

More Dividends Update from July 2020

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

I really feel great about this month. The positive energy is flowing through me and into all facets of life. As I come out of the debt pay down period it is very important to start researching for the next place that I want to allocate some fresh capital in the portfolio.

I have a few companies that I am currently looking at but I haven’t narrowed it down yet.

Plus we are moving into September which means more dividends. I know it may be kind of cliched but I love the last month of the quarter. These months really feel like a big pay off!!!

Let me know what you think about the August update.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article: