More Dividends Update from April & May 2020

Yep, that’s right. For the first time in over 5+ years of running this blog I finally missed a monthly update report for More Dividends. While I can’t totally represent the month of April, I will try my best to include what information that I can.

I would like to say that my work life had me so busy that I missed the monthly update. That would simply be a lie though. In April, I moved into a new apartment. Which in itself is not too bad but I have decided to downsize my belongings which has created a lot of extra work for me.

While I have used this opporunity to make a little extra income by selling items, it has also been hugely rewarding through the donations of items as well. It actually may have helped lead me to a non profit organization that I may begin volunteering some time with.

Despite me missing a monthly update, the portfolio has continued to perform. The market has been coming back from it’s low levels that were caused by the pandemic. During all the craziness, I was able to continue to add to my portfolio. I have still been picking my opportunities to add to existing positions.

Every month I do an analysis of my financial standings. I do this by calculating my net worth which is simply my assets versus my liabilities. With everything that happened in the market, my net worth took quite a hit. Since I decided to keep building onto my positions while it was at low levels I have seen some huge growth in my net worth as a result of this. Hopefully I will be able to continue creating such growth in my portfolio.

Only time will tell. Until then let’s take a look at any stock additions that were made over the past two months.

Stock Additions

These are the additions that were made during the months being reported on. Now, if you look at the current portfolio closely enough you will see that other stock additions have been made. Those additions won’t show up until next months report though.

Genuine Parts (GPC) – 6 shares

STORE Capital (STOR) – 3 shares

Stock Sells

It is not very common for me to sell any stock. I know that in my last report I made several sells but that was strictly to free myself from Robinhood. I would still love to build positions in those companies again.

So until further notice, I will be dropping the Stock Sells section from the website until I decide to sell some more again.

Dividends Received

I have been very impressed with how my 1st and 2nd months of the quarter have grown. I never consider when a dividend is paid when I do my analysis of a stock. This allows me more freedom to just buy into what I think is good companies. Maybe one day when I am looking to live off of the income then I will be more concerned with when my stocks pay a dividend.

Let’s take a look at all of the dividends that I have received since my last report!

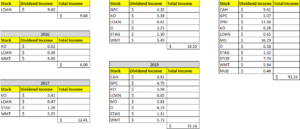

April 2020

Cardinal Health (CAH) – $9.41 – Reinvested

Genuine Parts (GPC) – $5.07 – Reinvested

JP Morgan Chase (JPM) – $13.50 – Reinvested

Coca Cola (KO) – $6.28 – Reinvested

Manhattan Bridge Capital (LOAN) – $.65 – Reinvested

Altria Group (MO) – $36.29 – Reinvested

Realty Income (O) – $6.58 – Reinvested

STAG Industrial (STAG) – $1.32

Store Capital (STOR) – $7.74

WalMart (WMT) – $5.94

iShares National Muni Bond ETF (MUB) – $0.46

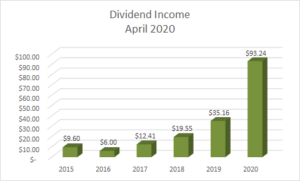

April was the first month of Q2 and accounted for $93.24 of my 2020 Dividend Income.

In total as of April during 2020, I earned $ $387.13 in dividend income!

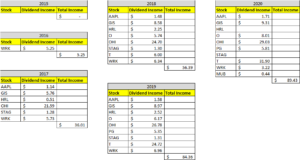

May 2020

Apple (APPL) – $1.71 – Reinvested

General Mills (GIS) – $9.31 – Reinvested

Realty Income (O) – $8.01 – Reinvested

Omega Healthcare Investors (OHI) – $29.03 – Reinvested

Procter & Gamble (PG) – $5.81 – Reinvested

AT&T (T) – $31.90 – Reinvested

WestRock (WRK) – $3.22 – Reinvested

iShares National Muni Bond ETF (MUB) – $0.44

May was the second month of Q2 and accounted for $89.43 of my 2020 Dividend Income.

In total as of May during 2020, I earned $ $476.56 in dividend income!

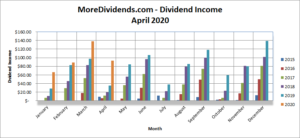

Dividends Received By Year

In April, my year over year dividend income increased by 165%. Once again, this isn’t something that I planned. I know that my stock additions have added to this growth but I am excited to try and keep this kind of growth going!

For there to be such growth during April, unfortunately I did not see the same in May. During the month, the portfolio only produced 6% in dividend income growth but that can pretty much all be attributed to reinvestment and dividend increases so you will be getting no complaints out of me!

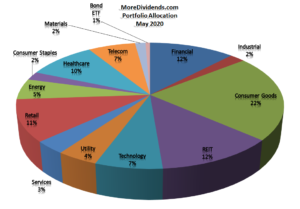

Portfolio Allocation

The portfolio allocation is a bit trickier. Since it is based on the current share price, I cannot really show what it would have looked like in April. That won’t stop us from seeing what the portfolio allocation looks like right now though.

Currently, my portfolio has gotten so large that my stock additions don’t affect the allocation levels too much. Most of the movement is created by movements in the market. Currently, I am ok with the current state of the portfolio. I would like to add to some of the lagging sectors but I will not place a buy order just to fill the void. I will continue to make solid analysis and only let portfolio allocation play a small role in my decision making process.

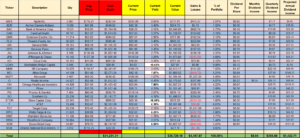

Current Portfolio

It is truly a joy to see the portfolio growing over time. Being able to buy when prices were depressed are leading to huge paper gains as the market has continued to bounce back from it’s lows. If the market starts reaching it’s highs again, I would definitly switch up my investing strategy if that were to happen.

Until then though, I will continue to secure some good opportunities as they present themselves.

MoreDividends.com Articles

Here are the 4 articles that I posted on MoreDividends.com since the last monthly update from oldest to newest.

More Dividends Update from March 2020

Johnson and Johnson Increases Their Dividend by 6.3% in 2020

Procter & Gamble Increases Their Dividend by 6% in 2020

Flowers Foods Increases Their Dividend by 5.3% in 2020

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Well now, wasn’t that one heck of a report. Because of reporting on 2 months in 1, more work has went into this report like no other. It was a different kind of experience to get to present the information this way but I think in the future I will go back to reporting it one month at a time.

Investing has been a part of my game for many years now so I always get excited whenever the market has these huge drops in price. I look at them as great buying opportunities and thus far have done pretty well as a result of them.

If the market drops again like many are forecasting then I will be waiting with more capital to put to work. If it continues to go up then I will adjust my strategy accordingly.

Have you recently been looking into some new companies? I would love to hear about them!

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

We missed you last month More Dividends. Congrats on a fantastic month!

Bert