More Dividends Update from March 2020

The excitement continued into March. We had some repositioning, some relocating, some buying, some selling and call kinds of adventures.

Well let’s start with the relocation. If you have noticed my absence lately, that would be due to the fact that I have recently moved myself into an apartment. In living a frugal lifestyle, I just couldn’t see paying a moving company. So, despite clocking 60 plus hours, I still managed to move myself into the apartment. One thing that will come of this my need to sell a lot of stuff. More to come on this later 🙂

Let’s take a look at how we did for the month.

Stock Additions

The buying spree continued into March. Some of these purchases were fueled by new capital while others were acquired through a redeployment of capital. In this effort, I was able to strengthen a lot of existing positions while lowering my cost basis on all of them. Good companies will continue to be good companies even during a crisis!

Let’s have a look at which companies looked the most intriguing to me.

JPMorgan Chase (JPM) – 3 shares

3M (MMM) – 3 shares

Realty Income (O) – 6 shares

ATT (T) – 10 shares

Wells Fargo (WFCO) – 5 shares

Stock Sells

It has been a long time since I have been able to use a heading like that. I am normally not a fan of having to sell stock. For reasons, beyond the companies themselves, I decided to close my positions in Hormel, Kroger and Stag Industrial.

I still like all 3 companies and would love to own their stock again some day!

The only reason I decided to sell them was because they were held on a RobinHood account. With all of their recent troubles I have decided to distance myself from the company as a whole. It was very frustrating in a time when I wanted to buy stock that I wasn’t able to and unfortunately that has consequences.

You may have also noticed that I no longer carry any affiliate links for RobinHood. This is a deliberate choice because I no longer support them and if you did start using their services because of me then I can only wish the best of luck in the future!

With the sell of these 3 positions, I was able to produce a bit of capital gains while also being able to reposition the funds in a tax sheltered account. Needless to say that there is more buying to do now!!!

Dividends Received

It wasn’t quite a record month but it was still a great month. The dividends received is continuously being strengthen through the use of dividend reinvestment. Plus some of the new additions will make an impact on my 3rd month of the quarter.

Let’s have a look at what companies paid me a dividend this month.

Archer Daniel Midland (ADM) – $4.67 – Reinvested

Bank of America (BAC) – $12.95 – Reinvested

Emerson Electric (EMR) – $5.55 – Reinvested

Flowers Foods (FLO) – $6.88 – Reinvested

Johnson & Johnson (JNJ) – $7.65 – Reinvested

Kroger (KR) – $4.32

3M (MMM) – $10.29 – Reinvested

Microsoft (MSFT) – $4.78 – Reinvested

Realty Income (O) – $6.54 – Reinvested

Pfizer (PF) – $8.80 – Reinvested

Southern Company (SO) – $15.50 – Reinvested

Stag Industrial (STAG) – $1.32

Target (TGT) – $13.28 – Reinvested

Wells Fargo (WFC) – $5.70 – Reinvested

Exxon Mobil (XOM) – $29.76 – Reinvested

March was the last month of Q1 and accounted for $137.99 of my 2020 Dividend Income.

In total during 2020, I earned $ $293.88 in dividend income!

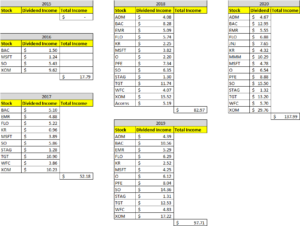

So far my dividends received looks like this

Dividends Received By Year

Looking at the year over year numbers they are great, considering I am 5+ years into this journey and am still able to create 41.2% growth. I would have thought the growth would have slowed more but then again I have been putting more money to work lately!

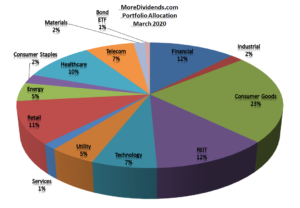

Portfolio Allocation

There’s not much to mention in regards to the portfolio allocation. One thing that I would like to note is the addition of a BOND ETF category on the chart.

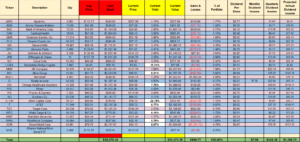

Current Portfolio

I love how the portfolio is positioned. I have been able to make a lot of great additions to the portfolio which has helped strengthen some of the existing positions. This month also saw me able to trim 3 positions out of the portfolio.

MoreDividends.com Articles

Here are the 6 articles that I posted on MoreDividends.com during March from oldest to newest.

All About Payout Ratios

More Dividends Update from February 2020

3M: Blue-Chip Dividend King Yielding 4%

Dividends: What are They and Why Do They Matter?

Realty Income Increases Their Dividend by 0.2% in 2020

Let’s Talk About Saving Money!

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Wowza. March had a lot of movement. For starters, I am glad to be able to reposition some of my funds in a tax sheltered account despite having to sell stock in some good companies to be able to do it.

Plus during the month, I was able to make quite a few purchases to help strengthen some of my existing positions.

If this month was an almost record, then I am looking forward to how well I do during the last month of next quarter! If things continue the way that they have been then it will be very nice. Given all of the uncertainty in the markets though, I know that nothing is guaranteed so it is not something that I am going to count on!

Now that I am finished with the move, be on the look out for a lot of new content to be coming to More Dividends. I am excited for this virus to be behind us so that I can get back to hiking and taking pictures!

I am very happy with the portfolios performance. I am very interested in hearing how well you did during the month of March!

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Almost a record month. It appears you’ve stepped up the YoY growth as well. Nice work, Jason.

You were busy with portfolio activity alright. I like the JPM and O additions, as both took what seem to be excessive tumbles in March.

Engineering Dividends recently posted…A of I – Opinion regarding stocks retesting their coronavirus lows

Congrats on receiving over $100 in dividend income for March. That’s fanatic! Way to have your money work hard for you so you don’t have to.

Nice job, Jason! $137.99 is a nice haul of dividends for the month. I like a lot of the names in your portfolio too. I want to own JNJ and MMM. Keep it up.

Reverse The Crush recently posted…AT&T Still A Buy After Earnings And CEO Retirement?