More Dividends Update From March 2017

Hey there readers, I hope that all has been going good for all of you lately. I am running a little bit behind on posting my monthly update but I have been reading some great monthly updates from other bloggers. There have been a lot of interesting purchases going on in the community lately including some recent ones that I made as well. Like most dividend investors March is one of my stronger months as far as dividend income is concerned. With this in mind I am very pleased to announce that March gave me a new record for dividend earned in a month.

During the month, I was also able to add a new position to my portfolio which is always exciting for me. Although I didn’t post many articles this month because I have been busy working on some side projects, I do have some articles on the way about a new investing strategies that I am trying as well as a post about a new book that I am reading. Many things to look forward to in the near future but first lets look at how this past month went for me.

Additions

During March, I decided to open a new position in General Mills and to build a little more on my Kroger position. I try to find good opportunities to continually add to my portfolio which will pay me dividends for years to come.

General Mills (GIS) – 12 shares – adds $23.04 to my yearly income

Kroger (KR) – 2 shares – adds $0.48 to my yearly income

This will add $23.52 to my Dividend Income for the year.

I will continue to look for good buying opportunities and continue to either establish new or build onto existing positions.

Dividends Received

**NEW RECORD MONTH**

Bank of America (BAC) – $5.10 – Reinvested

Emerson Electric (EMR) – $4.88 – Reinvested

Flowers Foods (FLO) – $5.22 – Reinvested

Kroger (KR) – $0.96

Microsoft (MSFT) – $3.89

Southern Company (SO) – $5.86 – Reinvested

Stag Industrial (STAG) – $1.28

Target (TGT) – $10.90 – Reinvested

Wells Fargo (WFC) – $3.86 – Reinvested

Exxon Mobil (XOM) – $10.23 – Reinvested

March was the last month of Q1 and accounted for $52.18 of my 2017 Dividend Income.

So far my dividends received looks like this

Dividends Received By Year

Wow what a nice year over year increase. 193% is definitely one of my better year over year increases so far. Moving forward I would love to be able to continue this type of growth but I am well aware that I am only able to produce that yoy because of the size of my portfolio.

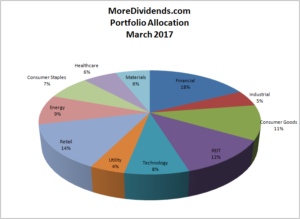

Portfolio Allocation

During this month with my Recent Buy of General Mills it allowed me to allocate more capital to Consumer Goods. My portfolio is still pretty well balanced. As my portfolio is growing it is helping to even out some of the sectors in which I was a little heavy in. I do refer to this pie chart sometimes when I am looking at future purchases because I don’t want to over allocate unless I think that a sector is going to outperform.

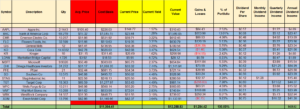

Current Portfolio

The current state of my portfolio is pretty good. It is evenly allocated and growing nicely.

MoreDividends.com Articles

Here are the articles that I posted on here during March.

More Dividends Update from February 2017

One Up On Wall Street by Peter Lynch

Recent Buy – General Mills (GIS) & a little Kroger (KR)

Conclusion

March turned out to be a great month for me. I hope that everyone else produced great months also. It was a record month for Dividend Income and I hope to be able to break that record soon. I was able to add another great company to my Portfolio. I was able to gain a lot of useful knowledge by continuing my financial education. All in all it was an awesome month and I look forward to building more months like it in the future.

Be sure to follow my new Page on Facebook at Facebook.com/MoreDividendsdotcom

Be sure to follow me on Twitter @MoreDividends

As always I look forward to reading all of your comments and questions, until then….. happy investing!

Great month More Dividends! Love how you aren’t settling here and continue to add to your positions with your GIS and KR buys. Strong companies and some strong brands for General Mills. Gotta love it!

Bert

“March gave me a new record for dividend earned in a month”.

Congratulations, More Dividends! That’s fantastic — I just love quarter-ending months because those are the months that we collect the most dividends. I think I’ll have a new record this month, too, although I haven’t tabulated the final numbers yet.

One thing is for sure, I won’t have the amazing year over year increase that you had!

Keep up the good work and happy investing!

Congrats on having a very solid month! Gotta love that you’re reinvesting most of the dividends to take advantage the power of compound interest.

Congrats on a great month and your new record! Always feels great to break through to a new high 🙂

MrSLM recently posted…Financial Update – March 2017

Congratulations on the record month! Your dividend growth year-over-year is really impressive. The detailed analysis of your portfolio is also interesting, you certainly have some great names in there. Thanks again for sharing and I hope June is even better for you!

Jay recently posted…Trend Following Trading Ideas for April 2017 (Part 2)

Another great investor buying General Mills. Good for you. It will turn out to be a great long-term investment.

Like the new GIS position. I just added to my GIS recently and started a position in my ROTH too. Congrats on a new record for the month and nice to see all that reinvesting going on too. That just keeps the dividend machine working even faster.

DivHut recently posted…Recent Stock Purchase April 2017

Solid month that will continue to grow years on end. good job

Doug recently posted…OHI buy

Nice results, thanks for your update!