More Dividends Update from January 2019

January 2019 is now in the books. The first month of a quarter has historically been a pretty small month of dividend income for me. Slowly I have been seeing these months grow larger. Soon they will be reaching highs like some of the other months are currently seeing.

When I am looking at companies to buy, I do not care when their dividend is paid. Thus, the first months of the quarter will grow but I choose to let it grow organically at this point.

Let’s take a look at how the portfolio has done during the month of January!

Stock Additions

During the month of January there were no new stock additions.

Dividends Received

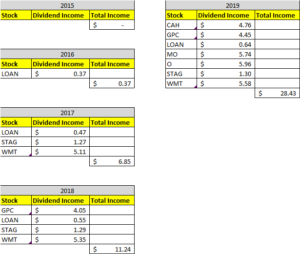

This month provided me with a new 1st month of the quarter high record. It’s not very much but I am glad to see the growth

Cardinal Health (CAH) – $4.76 – Reinvested

Genuine Parts (GPC) – $4.45 – Reinvested

Manhattan Bridge Capital (LOAN) – $.64 – Reinvested

Altria Group (MO) – $5.74 – Reinvested

Realty Income (O) – $5.96 – Reinvested

STAG Industrial (STAG) – $1.30

Walmart (WMT) – $5.58 – Reinvested

January was the first month of Q1 and accounted for $28.43 of my 2019 Dividend Income.

In total during 2019, I have earned $28.43 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 153% increase in dividends earned during the month of January. My stock purchases continue to help fuel this type of growth. As my dividend income continues to grow, my stock purchases will affect the year over year growth less but until then I will continue to enjoy seeing such large growth.

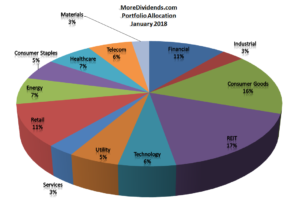

Portfolio Allocation

There was a small shift in the allocation but it was all caused by the fluctuations in the market. I am looking at some possible ways to shift some of my allocations. Only time will tell if any of them surface.

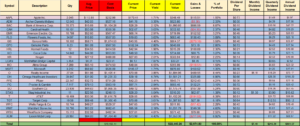

Current Portfolio

With no new additions my portfolio is pretty much the same. Some reinvested dividends and market fluctuations have caused all of the changes.

MoreDividends.com Articles

Here are the articles that I posted on MoreDividends.com during January from oldest to newest.

More Dividends Update from December 2018

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Autopilot for the win! The portfolio has been running by itself for sometime now and it continues to produce good results. Most of the income is reinvested so the portfolio is snowballing while running on autopilot.

There are no plans to take More Dividends off autopilot in the very short term but I do always keep my eyes open for good opportunities.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Most of your YoY increase is from new purchase. Grats! Save more, more dividend!

DSFI recently posted…Goals for 2019

I always try to invest as much as possible. Thanks for stopping by!