More Dividends Update from February 2021

Long time no see readers. I have missed a few months worth of updates because I have been spending more of my off time traveling to different places. Lately, I have been staying some what local but I see the travels spreading out more and more.

It is nice to know that while I am out playing that my portfolio will continue to work for me.

February didn’t start off as a great month for me when I first began investing but since that time it has really taken on a life of it’s own.

With continued growth and the dividends being reinvested, it will be very interesting to see how the growth will continue.

Let’s take a look at how the portfolio has performed during the month of February!

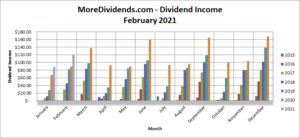

Dividends Received

February has become a great month for me. Years ago when I first started investing this seemed to be one of my weaker months. Since that time, I have built up a nice arsenal of stocks that pay dividends during the month of February. I have never bought any stocks based on when they pay their dividend.

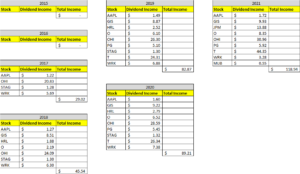

Let’s have a look at what companies paid me a dividend this month.

Apple (APPL) – $1.72- Reinvested

General Mills (GIS) – $9.93 – Reinvested

JP Morgan Chase (JPM) – $13.88

Realty Income (O) – $8.35 – Reinvested

Omega Healthcare Investors (OHI) – $30.96 – Reinvested

Procter & Gamble (PG) – $5.92 – Reinvested

AT&T (T) – $44.35 – Reinvested

WestRock (WRK) – $3.28 – Reinvested

iShares National Muni Bond ETF (MUB) – $0.55 – Reinvested

February was the second month of Q1 and accounted for $118.94 of my 2021 Dividend Income.

In total during 2021, I have earned $207.01 in dividend income!

So far my dividends received looks like this

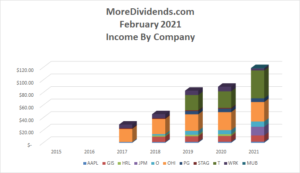

Dividends Received By Year

Despite how much growth I have seen during February, this month continues to produce a large 33.3% growth year over year. A lot of this was attributed to the strengthen of the position in ATT. Unless some more stocks were added I will not look to continue with this kind of growth.

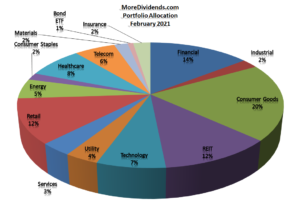

Portfolio Allocation

Small shifts in the portfolio allocation can all be attributed to shifts in the markets. It has been pretty consistent for a good number of months now.

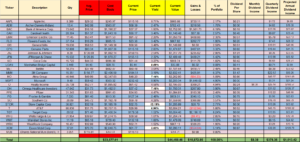

Current Portfolio

I love how the current portfolio is positioned. It is still well diversified and if I sold everything I would still see over a 30% return on my money mot even taking into account all of the dividends that have compounded in the portfolio!

MoreDividends.com Articles

Here are the 4 articles that I posted on MoreDividends.com during September from oldest to newest.

4 Ways You Can Start to Grow Your Company’s Business Credit in 2021

Genuine Parts Increases Their Dividend by 3.2% In 2021

Walmart Increases Their Dividend by 1.9% In 2021

Coca Cola Increases Their Dividend by 2.4% In 2021

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

This turned out to be a good solid month. I was rewarded with a nice stream of dividend income. All of the money was reinvested back into some more stock. ATT has proved to be a great dividend payer since I am able to acquire more than a whole share every time it pays me a dividend.

Building up solid positions will only help me grow this portfolio even quicker.

I have some more new adventures to tell you about in some of my upcoming post.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article: