More Dividends Update from December 2019

Another month is finished and in the books. December turned out to be a pretty interesting month for me. I began the month by working a lot of overtime on the job. Once the holidays came around though everything changed. I did some traveling and I spent the holidays with family. So I was able to end the month on a very relaxing note!

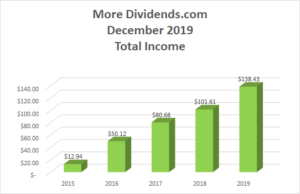

December was great because I set a new high for my dividend income. The growth is really starting to put some weight behind my compounding factor. Plus during the month I was able to make a couple of small purchases to help fuel the growth in the portfolio.

Let’s take a look at how we did for the month.

Stock Additions

This was finally the month that I decided to deploy some of the capital that I have been storing up. Both are good companies that I am looking forward to building some strong positions with. 3M is a great company that has a tremendous product line which is well diversified. The company has a long history of growing their dividend and I look forward to watching as my dividend income from them grows for many years to come. After making the purchase of 3m I decided that I wanted to start a new position with a REIT. It didn’t take me long to find that a good company to invest my money into was going to be Store Capital.

3M Company (MMM) – 4 shares

Store Capital Corp (STOR) – 13 shares

Dividends Received

BOOM! Confetti covers the sky and it pleases me to say that this is a new record for my dividend income. Every month my income grows larger. When the quarter gets to that last month it always seems to break the record. Fortunately, this month was no different.

Let’s take a look at who all contributed to this record breaking month.

Archer Daniel Midland (ADM) – $4.50 – Reinvested

Bank of America (BAC) – $12.88 – Reinvested

Emerson Electric (EMR) – $5.52 – Reinvested

Flowers Foods (FLO) – $6.82 – Reinvested

Johnson & Johnson (JNJ) – $7.60 – Reinvested

Coca Cola (KO) – $6.08 – Reinvested

Kroger (KR) – $4.32

Microsoft (MSFT) – $4.76 – Reinvested

Realty Income (O) – $6.33 – Reinvested

Pfizer (PF) – $8.26 – Reinvested

Southern Company (SO) – $15.35 – Reinvested

Stag Industrial (STAG) – $1.31

Target (TGT) – $13.21 – Reinvested

Wells Fargo (WFC) – $5.65 – Reinvested

WestRock (WRK) – $7.30 – Reinvested

Exxon Mobil (XOM) – $24.76 – Reinvested

December was the last month of Q4 and accounted for $138.43 of my 2019 Dividend Income.

In total during 2019, I earned $ $953.70 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

After seeing a decline in growth last month, I am looking forward to seeing how the portfolio did in December. Year over year during the month the portfolio saw a 36% increase .

Let’s take a look at the growth for December!

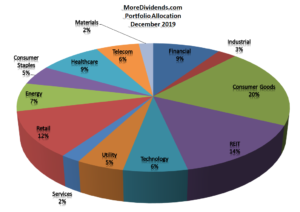

Portfolio Allocation

With the new purchases I could see a slight bit of extension in the REITs and Consumer Goods sectors. Other than that the market fluctuations have held the allocation pretty stable.

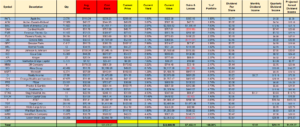

Current Portfolio

The portfolio is doing amazing. I love the size and growth that I am seeing. The dividends are really starting to compound and I can really see the compounding effect in action!

MoreDividends.com Articles

Here are the 4 articles that I posted on MoreDividends.com during December from oldest to newest.

More Dividends Update from November 2019

Realty Income (O) Increases Their Dividend 0.2%

AT&T (T) Increases Their Dividend 2%

Pfizer (PFE) Increased Their Dividend by 5.6%

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

What an exciting month that December has been. The weather cooled off but portfolio heated up. I love the growth and sustainability that I am seeing with the portfolio.

You have heard about what has been going on here lately! Leave me a comment down below and let me know how your portfolio performed during the month of December.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article: