More Dividends Update from July 2017

Welcome back readers. Another month has passed and there wasn’t many fireworks here at More Dividends. The first month of the quarter is always my weakest month and I don’t seem to help the situation much since I don’t buy stocks based on when the dividend is paid. But there were some additions made to the portfolio this month. Not only did I start a new position but I also strengthened one of my existing positions. Without further adieu I will jump right into this months update.

Additions

During July, I did make a couple of purchases.

Archer-Daniels-Midland (ADM) – 12 shares – adds $15.36 to my projected annual dividend income

General Mills (GIS) – 5 shares – adds $9.80 to my projected annual dividend income

These were a some great additions for my portfolio. I believe that their dividend is safe and will continue to give me a return on my investment for many years to come.

Dividends Received

Like most dividend growth investors, July is not one of my strong months. I don’t invest in companies based on when they pay dividends so the first month of the quarter will probably continue to lag the other months tremendously. With the transfer of some of my stocks into my regular taxable account this will actually be the first month that I will be able to DRIP my Coca Cola dividends.

Coca Cola (KO) – $5.18 – Reinvested

Manhattan Bridge Capital (LOAN) – $.49 – Reinvested

STAG Industrial (STAG) – $1.28 –

July was the first month of Q3 and accounted for $6.95 of my 2017 Dividend Income.

So far my dividends received looks like this

Dividends Received By Year

Sadly I still haven’t been able to top the amount of dividends that I received my first year but I am positioning myself to be able to through reinvesting the dividends. Although I haven’t topped the first year I did see some great yoy growth since last year.

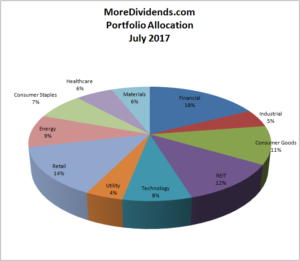

Portfolio Allocation

There isn’t a lot of change in my portfolio allocation. The main change that happened was that both new additions added to my Consumer Goods holdings. I’m still pretty well diversiefied with no sector accounting for more than 20% of my portfolio.

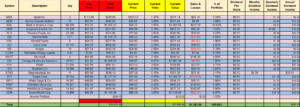

Current Portfolio

All of the above mentioned additions show up in the new snapshot of my portfolio. Plus I decided to start listing my Acorns account in my portfolio.

MoreDividends.com Articles

Here are the articles that I posted on here during June.

More Dividends Update from June 2017

Update On Pending Dividends

The Millionaire Next Door: Surprising Secrets of Americas Wealthy

Dividend Increase – Omega Healthcare Investors (OHI)

Update On Acorns

Recent Buy – Archer-Daniels-Midland (ADM) and General Mills (GIS)/a>

If you are interested in posting guest post, just head over to the Contact Page and send me a message.

Conclusion

July is a slow month for me but it was still very productive. I made a couple of new buys of some good companies. I was able to post 6 articles on the blog during the month. I am getting closer and closer to reaching my 100th post which I am very excited about. I am looking forward to the next 2 months because they produce more income for me.

I’m looking forward to continuing to build my investment portfolio, not just in dividend stocks but in all the investment vehicles that I use.

I appreciate everyone who sticks around and reads my blog posts and I greatly enjoy reading your thoughts on my post

Be sure to like my new Page on Facebook at Facebook.com/MoreDividendsdotcom

Be sure to follow me on Twitter @MoreDividends

As always I look forward to reading all of your comments and questions, until then….. happy investing!

July was pretty slow for me too. My biggest payer was GE, and I sold it at the end of the month. Interestingly enough, I usually do the best in the second month of the quarter because of AT & T and OHI and their high yields. Congrats on the year-over-year growth.

Thank you. Yeah, OHI is a high yielder for me too.

Hey we all have slow months in July! Love the growth rate here and I am digging the new buys of the classic ADM and GIS. I am always looking at GIS in my quest to find some good dividend stocks to my portfolio!

Bert

Yeah, 1st month is always a bummer for me but like you said as long as I am showing good yoy growth then I am ok with it.

Keep up the good work. We all feel a little let down coming off a June high. Seems like every portfolio out there is bringing in smaller numbers. Just focus on that year over year growth rate and your annual totals. As long as that remains on track you are golden. Of course, adding ADM and GIS helps move that snowball along a little faster. Like those buys!

DivHut recently posted…Recent Stock Purchase August 2017

Thanks DivHut. You are exactly right. As long as my total portfolio continues to grow I am ok with it. I am looking at another good company that should help move that needle even more. Only time will tell when I decided to pull the trigger and pick it up though. Thanks for stopping by.

Yea, July has been an off month for a lot of folks, including myself. But, you’re still adding shares to your portfolio and still experiencing the power of compounding. Well done.

Dividend Portfolio recently posted…Whoops

Albeit a slow month, still solid results and you made some nice buys! Onwards and upwards!

Mr. Robot recently posted…This is my buy for August 2017