What’s the difference in EPS and diluted EPS?

Hey there future and current investors. Recently, I was approached with a question by a colleague of mine that I work with, who is aware of the fact that I invest in dividend stocks but has no idea that I run a blog about it……. Shhhh! Maybe I will let him in on the secret one day. Since he was intrigued enough to want to know the answer, I thought that I would answer the question here as well.

Now this particular colleague has been investing in mutual funds for years but has recently taken an interest in buying some individual stocks. He has some basic knowledge but he jumped right into looking over the income statement of a potential investment and was quickly stumped by something that he saw. While he had some idea what a basic EPS figure was, he had no idea what a diluted EPS figure was.

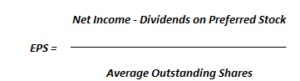

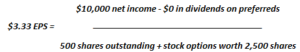

So let’s break this down and learn exactly what he was looking at. The acronym EPS is short for Earnings Per Share. A basic eps is exactly what it sounds like, it is how much money the company earned minus dividends on preferred stock divided by the average number of outstanding shares during the reporting period. If this were presented as a formula it would look something like this

EPS is a very popular way that investors use to analyze a stock. I advise new investors to beware that they’re ways to manipulate EPS but I am not going to go into them here in this article. I do think it is important for a new investor to be aware of this though.

Now that we know what a basic EPS is telling us, let’s learn about a diluted EPS.

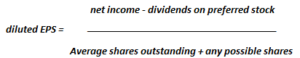

A diluted EPS is similar to a basic EPS but it adjust for any possible dilution that, if exercised at that moment, would cause the reported earnings per share to be lower than it was reported. You may be asking what are possible forms of dilution. Some examples of methods of dilution would be convertible preferred shares, convertible debentures, stock options and warrants. So, let’s take a look at the formula for diluted EPS.

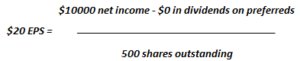

Now, let’s take and apply these two forms of EPS to an example. For this example I am going to use small numbers so that it is easier to wrap your head around these concepts but in reality most EPS numbers you will be dealing with is more in the millions and billions.

Company ABC reports a net income of $10,000 during the first quarter of the year. During the same period the company paid out no dividends on its preferred shares. The company only had 500 shares outstanding during this period. Now we have all of the information that we need. So let’s plug it into our formula and see what we end up with.

So here we can see that during the quarter that Company ABC has an EPS of $20. Which appears to be a great number and most investors would love to invest their money based on this kind of metric… but now let’s look at the diluted EPS for the same time period.

Let’s say that Company ABC had given their CEO stock options and he had chosen not to exercise them yet. If the CEO currently had stock options worth 2500 shares then we would be looking at a situation that looked more like this.

Wow… that diluted EPS number sure can make a difference. Of course it all depends on if the owner of the option decides to exercise it or not. It is very possible that the CEO could wait several more quarters before choosing to exercise his option to pickup these shares in Company ABC. What I would watch for is the trend in the stock price of the company. No sane person is going to choose to exercise his stock option if the strike price is less than what he could buy it for at the stock exchange. If the stock price has been trending upward though there is a greater chance that someone may choose to exercise their stock option. That is not to say that they are going to exercise the option and collect all 2,500 shares. If they think that the stock price will continue to move up, it may be in their best interest to only collect a percentage of the option now and then collect more shares later on if the stock continues to move up.

Like everything else in investing there is no guaranteed way to do something. Observing the EPS and diluted EPS can give you some insights as you analyze a company as a potential investment. It by far is not the only thing that you would want to look at but it can give you great perspective about the possible dilution of shares in a given company. Remember that any dilution of shares actually means that you own less of the same exact company.

I hope that this article has helped in your understanding about the difference in basic EPS and diluted EPS. Please feel free to share this article with your friends and I welcome you leave me some comments down below.

Thanks for the info! Makes sense.

Gotta love the co-workers that have no idea you run a blog about things and ask you questions. I often find it difficult to hold back my excitement when someone brings up stocks/401k/mortgages/etc. Its weird when someone at age 60 says, I think if I work just 5 -10 more years I’ll be good to retire. Unreal.

The fact I plan to retire at half their age is amazing to me. Love this community!

American Dividend Dream recently posted…Dividend Income – July 2016 Update