More Dividends Update From December 2017

December turned out to be a great month for me. I almost received a dividend income this month equal to that of the whole first quarter. I am very excited to reach a milestone of receiving a $100 in a single month and I feel like I will be able to do this very soon. After finishing my last book about Ben Franklin, I quickly jumped into another book which I will be posting about in the near future. I thoroughly enjoy the amount of reading time that I have had lately.

My portfolio has largely been on autopilot lately but it is still working for me nicely. Some new purchases are in the work and I am excited to share those with you in the future a long with several of articles that I am working on.

So let’s take a look back and see how my portfolio has changed during the month of December.

Additions

There was no major additions to my portfolio during the month for good reasons. I am looking into a couple of additions to my portfolio in the near future so keep your eyes open for this.

Dividends Received

December produced the most dividend income for me yet. As mentioned above I am highly anticipating the $100 in a single month milestone. I feel like I will easily be able to reach this before the end of Q2 in 2018.

**NEW RECORD MONTH**

Archer Daniel Midland (ADM) – $3.87 – Reinvested

Bank of America (BAC) – $8.25 – Reinvested

Emerson Electric (EMR) – $5.05 – Reinvested

Flowers Foods (FLO) – $5.69 – Reinvested

Kroger (KR) – $2.25

Microsoft (MSFT) – $3.80 – Reinvested

Pfizer (PF) – $6.85 – Reinvested

Southern Company (SO) – $6.28 – Reinvested

Stag Industrial (STAG) – $1.29

Target (TGT) – $11.63 – Reinvested

Wells Fargo (WFC) – $4.04 – Reinvested

Exxon Mobil (XOM) – $10.80 – Reinvested

Acorns Portfolio – $5.61 – Reinvested

December was the last month of Q4 and accounted for $80.68 of my 2017 Dividend Income.

In total during 2017 I earned $453.13 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 61% increase in dividends earned during the month of December. The reinvested dividends helped out here but the additions were the real powerhouses. I hope to be able to continue producing this kind of year over year growth but I am seeing the growth rate slow down the larger the amount of dividend income grows. I do not mind as long as I continue seeing growth because I will not be able to keep up the growth by purchases a long.

Portfolio Allocation

With no big additions to my portfolio there isn’t going to be a big change in the allocation. Any changes are just caused by the movements of the market.

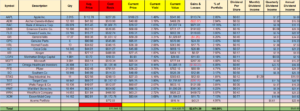

Current Portfolio

My portfolio hasn’t changed a lot since November. The only changes that have happened are all because of the market. So I am pleased with my current holdings.

MoreDividends.com Articles

Here are the articles that I posted on here during December from oldest to newest.

More Dividends Update From November 2017

What numbers I pay attention to

100th Post Celebration

Dividend Increase – Pfizer (PFE)

Benjamin Franklin: An American Life

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

What a great way to end the year. A new record high for dividend income. Some great new articles were posted. Some good books were read.

The MoreDividends portfolio is chugging along nicely. I engage in a lot of investing outside of this portfolio and I will be sharing some of these vehicles in the future. I am constantly learning and always looking for new ways to grow my wealth and knowledge.

It has been a great year but I am looking forward to what 2018 brings for me.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook

@MoreDividends on Twitter

Congrats MD. Nice dividends and diversified selection of stocks. I am more of ETF player.

dividendgeek recently posted…December 2017 : Investment Portfolio Status

I appreciate it dividendgeek. Thanks for stopping by.

It appears that you have a nice selection of stocks. I hold a few shares of OHI and KR as well. Onward and upward in 2018!

I appreciate it. Glad to meet a fellow shareholder. Thanks for stopping by.

Congrats MD on the record month and the solid year. Looking forward to see what the next year brings for you!

timeinthemarket recently posted…Time in the Market dividend review – December 2017

I appreciate it timeinthemarket. Thanks for stopping by.

More Dividends,

Nice way to end the year. You have a great selection of diversified stocks paying you this month. It will work out great for you in the long run.

Scott

I appreciate it Scott. I try to pay attention to my diversification but if I see an opporunity I am willing to acquire it anyways. Thanks for stopping by!

Congrats on a strong finish. We actually have a similar sized portfolio. I earned $76 in dividends in December, which is close to what you earned. You have some strong companies paying you dividends MD. Looking forward to following your progress in 2018.

Dividend Portfolio recently posted…Resolutions – 2018

i appreciate it DP. I look forward to seeing thee progress that you make in 2018 as well.

Looks like ‘More Dividends’ are continuing to come your way. Congrats on a solid December showing with a very nice year over year gain too. Looks like we share a handful of common names paying us last month. Always nice to see. Keep it going in 2018. Look forward to following your journey.

DivHut recently posted…January 2018 Stock Considerations

Thanks DH. I’m proud to be a fellow shareholder of some great companies with you. Thanks for stopping by.