Review of the Simply Investing Report

I would like to welcome you to this review of the Simply Investing Report. I have been partnered with Simply Investing for a number of years now.

You may remember back in 2016 when I posted an interview with Kanwal Sarai from Simply Investing. Kanwal has a long history of some great returns in the markets.

While Simply Investing does offer a full course on dividend investing, today I just want to focus on the monthly report that they publish.

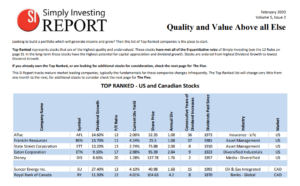

Top US and Canadian Stocks

The first thing that jumps out to me is that on the first page there is a table that shows the Top US and Canadian stocks.

I liked seeing this table because it gives some quick ideas of some good companies worth looking into. I know that once I saw the Top US and Canadian stocks table, that I was very interested in looking deeper into Aflac because I think it would fit nicely into my portfolio.

In This Issue

The other item that caught my eye on this first page was the In This Issue section. This acts as nothing more than a Table of Contents.

The thing that really caught my eye was that the report was not just full of information of analysis on stocks. It turns out to include some analysis information but there is some other content in each issue that revolves around enhancing your skills as an investor. We quickly see that it includes some tips on Building Your Portfolio as well as talking about the 12 Rules of Simply Investing.

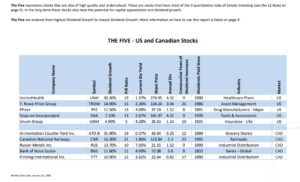

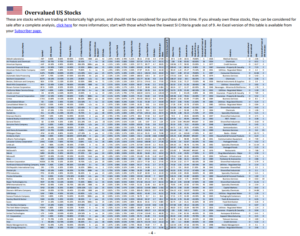

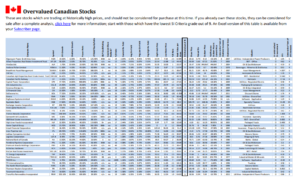

The Five and UnderValued/Overvalued Stocks

As we can see here on the screenshot, The Five represents the top stocks that are both high quality and undervalued.

The Five is determined by using the 12 Rules of Simply Investing. Again this adds a nice little snapshot of some good companies that are worth looking into a bit more.

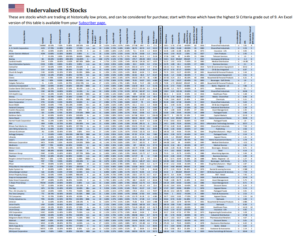

The author does a great job including these little snapshots for the reader but then he takes it a step farther by including some larger list of undervalued and overvalued stocks.

Have you noticed a trend with these stock charts? Well if you guessed that they are being presented with US stocks and with Canadian stocks then you would be correct!

By covering both American and Canadian stocks the author adds some great additional value in the Simply Investing Report.

Beyond The Tables

We are only a couple of pages into the report and it has already provided an abundance of stock ideas. We have been provided several tables full of information of metrics on the prospective companies.

As I said earlier, one of the things that I do like about the Simply Investing Report is that it is not just a bunch of stock ideas but it also serves to help educate the reader.

The author covers some very important topics like a review of the month from an investing point of view as well as giving some great tips on how to build your portfolio of dividend paying stocks.

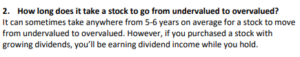

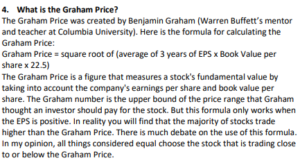

Toward the end of the report, we are provided with a break down of all of the different metrics that were used in the tables of stock information. Some of the metrics you will be familiar with like a PE ratio or a dividend growth rate. Other metrics like a Graham Price may not be as familiar. So it is definitely advisable to not underestimate any section in this report. While it may be presented very simply, there is still a wealth of information that Kanwal has provided to us the readers.

I am old school internet so I am a huge fan of Frequently Asked Questions and that is exactly how this report ended. I will provide a couple of snippets of some of the FAQs.

What’s the Cost?

If this monthly Simply Investing Report is something that you are interested in then you are provided with two different payment options.

The easiest option and the best value for your money is the annual subscription for $199. At that price, it breaks down to $16.58 per report.

The second option would be the monthly plan. If you decide on the more tedious of the two plans, then it will cost $19 a month.

Either option is definitely affordable for the value that you will get!!!

Just click on the Simply Investing Report link and sign up!

Wrapping It Up

As we can see here, this report is chopped full of information. With an annual subscription for only $199, you will be entitled to the Simply Investing Report for the next 12 months which will greatly improve your chance at investing success.

How could you not look forward to this monthly report.

For starters, it narrows down to just a handful of undervalued stocks for you to look at. Not only American companies but Canadian companies are also provided. Plus, if you follow this report month after month then you will be guaranteed to add a lot of new knowledge about investing.

You will learn new concepts about investing or some new metrics that you have never used before.

Plus the author offers some investing strategies to help you navigate things that may be happening in the current market environment.

I highly recommend this report. It is a great value for the dollar amount that you actually spend on it. It makes a great addition in any investors selection of resources that they use in their investing endeavors.

Do you currently subscribe to this Simply Investing Report because I would love to hear your opinion about it.

If not the Simply Investing Report, do you subscribe to other newsletters? Because I would love to hear about some of the other resources that you have used.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article: