The Power of Compounding Interest with Dividend Growth Stocks: Coca-Cola as a Case Study

Compounding is often referred to as the “eighth wonder of the world.” Albert Einstein is famously credited with saying that “he who understands it, earns it; he who doesn’t, pays it.” While compounding applies to many areas of finance, one of the most powerful demonstrations of its strength is seen in dividend growth investing.

Among dividend-paying companies, The Coca-Cola Company (ticker: KO) has stood as one of the most iconic examples of how consistent dividend payments, coupled with reinvestment, can create immense wealth over time. By examining Coca-Cola’s history as a dividend growth stock, we can gain a clear understanding of how compounding interest works in practice and why it remains such a powerful wealth-building strategy.

Understanding Compounding and Dividend Growth

At its core, compounding is the process of generating earnings on both the initial principal and on accumulated interest or reinvested dividends. In the stock market, compounding is best realized when dividends are reinvested to purchase more shares, which in turn generate more dividends. Over time, this cycle leads to exponential growth in wealth.

Dividend growth investing takes this concept further by focusing on companies that not only pay dividends but also consistently raise them year after year. A growing dividend means that investors not only earn income but see that income increase annually, often outpacing inflation. Unlike relying solely on stock price appreciation, dividend growth investing provides tangible, recurring cash flow that compounds over decades.

Coca-Cola: A Dividend Growth Powerhouse

Coca-Cola is one of the world’s most recognized consumer brands, selling beverages in over 200 countries. Beyond its global reach and strong competitive moat, Coca-Cola has built a reputation as a reliable dividend payer.

- Dividend History: Coca-Cola has paid dividends every year since 1920 and has increased its annual dividend for more than 60 consecutive years, making it a “Dividend King.” This remarkable streak demonstrates management’s commitment to returning capital to shareholders and the company’s ability to generate consistent free cash flow.

- Dividend Yield and Growth: As of recent years, Coca-Cola typically yields between 2.5% and 3.5%, depending on its stock price. More importantly, the company has steadily grown its dividend payout by around 5% annually in the past decade, though historically, growth has been even higher.

This combination of reliability and growth makes Coca-Cola an ideal candidate to illustrate the compounding power of reinvested dividends.

How Dividend Reinvestment Works in Practice

Imagine an investor purchasing $10,000 worth of Coca-Cola stock decades ago. Instead of withdrawing dividends as cash, the investor chooses to reinvest them through a Dividend Reinvestment Plan (DRIP). Each quarter, the dividends automatically buy additional fractional shares of Coca-Cola, which then produce dividends of their own. Over time, the number of shares grows significantly, and with each dividend increase, the income stream rises even faster.

For example, someone who invested $1,000 in Coca-Cola stock in the 80s—around the time Warren Buffett’s Berkshire Hathaway began buying shares—would today have a position worth hundreds of thousands of dollars, largely thanks to reinvested dividends and stock splits. Buffett himself has frequently praised Coca-Cola as a quintessential example of the power of compounding, pointing out how Berkshire Hathaway’s annual dividend income from Coke has grown to over $700 million on its original $1.3 billion investment.

The Mathematics of Compounding with Coca-Cola

To illustrate with approximate numbers, let’s consider an investor who purchased 100 shares of Coca-Cola in 1985 at a split-adjusted cost of around $3.50 per share. That initial investment would have been $350.

- Stock Splits: Since then, Coca-Cola has undergone multiple stock splits, increasing the number of shares owned. Those 100 shares would now be 2,400 shares today.

- Dividend Growth: Coca-Cola paid about $0.08 per share annually in 1985. Today, the company pays around $1.84 per share annually. That means the original $350 investment now generates over $4,400 in dividends per year.

- Yield on Cost: The yield on cost (annual dividend divided by original investment) is more than 1,200%. In other words, each year, the investor receives more than 12 times their original investment—without selling a single share.

This is the essence of compounding. The dividends reinvested over decades not only increased the number of shares but also benefited from the growth in per-share dividends, creating exponential income growth.

Why Dividend Growth Investing Works Long-Term

Several factors make dividend growth investing, especially with companies like Coca-Cola, an effective strategy for building wealth:

- Stability and Predictability

- Dividend Increases Outpace Inflation

- Behavioral Advantage

- Reinvestment Creates Exponential Growth

Coca-Cola’s products are consumed globally and daily. This predictable demand provides steady revenue streams, which in turn supports reliable dividends. Investors can rely on a consistent cash return, regardless of market volatility.

Inflation erodes the value of fixed income. However, dividend growth stocks provide an income stream that grows over time, maintaining purchasing power. Coca-Cola’s decades of dividend increases have far outpaced inflation, making it a hedge against rising costs.

Investors who focus on dividend income are less likely to sell during market downturns. While stock prices may fluctuate, dividends from strong companies remain relatively stable, encouraging a long-term mindset that maximizes compounding.

Dividends reinvested during bear markets buy more shares at lower prices, amplifying long-term returns when prices recover. The discipline of reinvesting dividends transforms temporary market weakness into long-term strength.

Lessons from Warren Buffett and Coca-Cola

No discussion of Coca-Cola and compounding would be complete without highlighting Warren Buffett’s experience. Berkshire Hathaway purchased Coca-Cola shares in 1988 for about $1.3 billion. Today, those shares are worth more than $25 billion. But more impressively, Coca-Cola pays Berkshire over $700 million annually in dividends, meaning Buffett recoups over half of his original investment every two years in cash flow alone.

Buffett’s success with Coca-Cola underscores two key lessons:

Long-term holding of high-quality dividend growth stocks magnifies compounding.

The real power lies not in trading stocks but in allowing time, dividends, and reinvestment to do the heavy lifting.

Potential Risks and Considerations

While Coca-Cola provides a powerful example, investors must also recognize potential risks:

- Slower Growth: As a mature company, Coca-Cola’s growth prospects are slower compared to younger firms. Dividend growth may be more modest in the future.

- Currency and Market Risks: Coca-Cola earns a large portion of revenue internationally, exposing it to foreign exchange fluctuations and changing consumer preferences.

- Overreliance: Compounding works best when combined with diversification. While Coca-Cola is strong, investors should hold a portfolio of dividend growth stocks across sectors.

The Timeless Power of Compounding

The story of Coca-Cola as a dividend growth stock demonstrates why compounding is one of the most powerful forces in investing. Through reinvested dividends and decades of steady growth, even a modest investment can snowball into significant wealth and income. Investors who understand this principle and apply it with discipline can achieve financial independence not through speculation, but through patience and consistency.

Coca-Cola remains a living testament to this truth. A simple soda company became one of the greatest wealth-generating machines in history, not by chasing trends, but by steadily paying and growing its dividend. For investors seeking long-term financial success, there may be no better lesson than to buy quality dividend growth stocks, reinvest the dividends, and let the magic of compounding work over time.

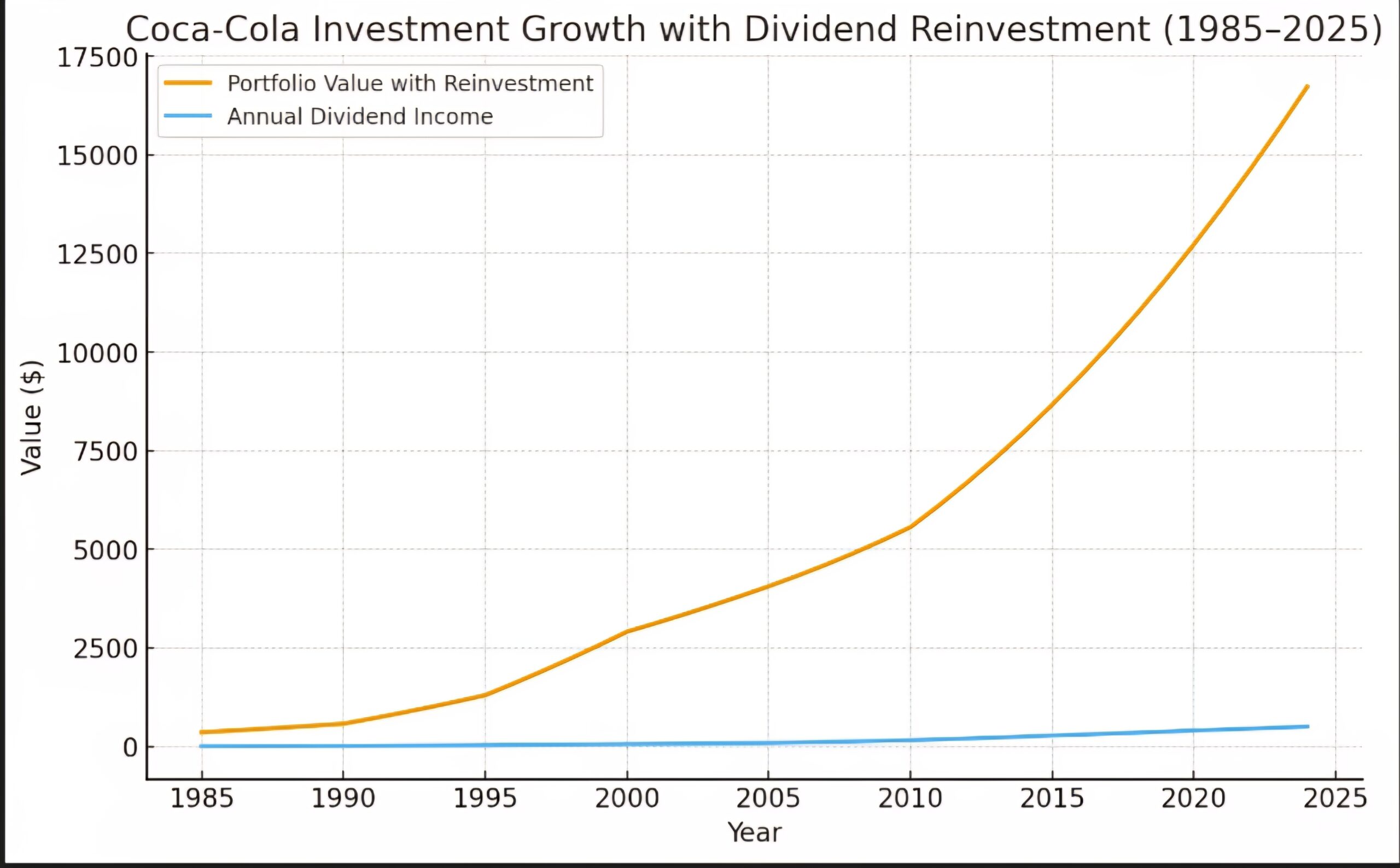

Here’s a chart showing how an initial $350 investment in Coca-Cola in 1985 could grow with dividend reinvestment.

The blue line shows the portfolio value compounding over time.

The orange line shows annual dividend income, which rises significantly due to dividend growth and reinvestment.