Dividend Safety Analysis: Apple (AAPL)

This is a guest post from Dividend Power of DividendPower.org

Apple Overview

In this article I present a dividend safety analysis of Apple Inc (AAPL). The well-known company sells personal electronics and services globally. The company is one of the top two companies by market capitalization at over $1.2T. Apple is a dividend growth stock having raised the dividend for seven consecutive years. This makes the company a Dividend Challenger. The current yield is low at about 1.1% but the safety is rock solid from the perspective of earnings, free cash flow, and debt, as I discuss below.

Before I present the dividend safety analysis, let’s first discuss Apple’s businesses. Apple reports two business segments products and services. The company sells iPhones, iPads, Macs, Apple Watches, Apple TVs, Air Pods, and other electronic devices. The iPhone makes up the great majority of total revenue. In addition, Apple offers services including Apple Music, iCloud, Apple Care, Apple TV, Apple Arcade, Apple Card, Apple Pay, and others. Apple is known for its ability to integrate hardware, software, services, and functionality. Notably, Apple’s ecosystem is self-contained, meaning that it designs most of the components and software in a product. However, Apple does use contract manufacturing and allow third-party applications through its App Store. Apple has arguably built a strong moat based on its technological prowess, network of third-party apps, and customer loyalty. There are about 1.4 billion Apple devices in use today and this number is rising annually. Most customers remain loyal and upgrade rather than switch to another brand. Furthermore, customers often add additional devices making switching to another brand cost prohibitive and often very inconvenient.

Apple’s top line continues to grow at a pretty rapid pace on the strength of the iPhone, which provides the great majority of sales (55%). But other devices also provide increasing sales with time. Most Apple devices become obsolete in a few years and customers need to upgrade often at higher prices. In addition, Apple’s services and wearables sales are increasing at a rapid clip. The company seems to have big hit with the Air Pods and in addition Apple Watch sales are growing.

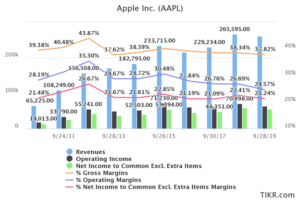

The result is that in the past decade Apple has grown revenue from $65.2B in fiscal 2010 to over $260B in fiscal 2019. This growth has driven growth of the bottom line. In turn the stock price has risen dramatically in the past 10 years. Note that Apple’s revenue does on occasion dip due to poorly received iPhone update cycles. But the company has demonstrated the ability to recover from periodic missteps.

Surprisingly, Apple’s gross margins, operating margins, and net profit margins are not that high when compared to some other tech companies. For example, Cisco Systems (CSCO) boasts higher gross margins. While Microsoft Corporation (MSFT) has higher margins across the board. But with that said, Apple has high margins relative to many other tech companies and sells large volumes of devices and services leading to high operating earnings and cash flows.

Apple’s Dividend Safety

Let’s now examine the dividend safety of Apple. From the perspective of earnings, the dividend is extremely well covered. Fiscal 2019 diluted earnings per share was $11.89, and the annual dividend is $3.04 per share. This gives a payout ratio of 25.6%. This is an excellent value and below that of many well-known dividend growth stocks. The payout ratio is also below my threshold of 65%. Stocks with payout ratios above this amount can often be considered to have riskier dividends.

The dividend is also well-covered by free cash flow. In fiscal 2019, operating cash flow was $69,391M and capital expenditures were $10,495M. This gives free cash flow of $58,896M. The dividend required $14,199M in fiscal 2019. The dividend-to-FCF ratio was ~24.1%. This is also an excellent value and better than that of many well-known dividend growth stocks. This ratio is also below my criteria of 70%.

Debt also does not seemingly pose a current risk to the dividend. Apple boasts a whopping $48,844M in cash and equivalents and $51,713M in short-term investments on hand. Short-term debt is $16,240M and long-term debt is $91,807M. This seems high but net debt is only $7,490M. Given Apple’s cash flow debt can be paid off rapidly. Interest coverage is over 17X and leverage ratio is about 0.1X, which are excellent values. At the moment, debt does not place the dividend at risk.

Final Thoughts On Apple

Apple is an attractive dividend growth stock. The yield is low, but the dividend is very safe due to Apple’s growing earnings and cash flow. Debt is rising but Apple still has very good debt metrics. Apple’s dividend will probably continue to grow as long as the iPhone and ancillary devices stay in demand. The low payout ratio supports further dividend growth. I expect that Apple will become a Dividend Contender in a few years. At present, Apple is a conservative dividend growth stock.

BIO: Dividend Power is a blogger on dividend growth stocks and personal finance. He also works as a part-time freelance equity analyst with a leading newsletter on dividend stocks. Dividend Power also provides analyses on Seeking Alpha. He is currently is in the top 10% out of over 7,100 financial bloggers as tracked by TipRanks (an independent analyst tracking site).

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook

@MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Thanks for your overview!