WestRock Vs. International Paper

A lot of companies affect us tremendously and we may have never even heard of the companies. Two such companies are WestRock and International Paper. While you may have never heard of either company I am positive that you have dealt with their products. That is because they make products that we deal with in our everyday lives. They produce a wide range of products including packaging boxes, product displays, pizza boxes, beer boxes and many more.

While they aren’t a fancy new tech company, I would consider them good companies that operate in a boring industry that would be a great addition in any dividend growth investors portfolio.

So I want to take a few minutes and look at some key metrics for both businesses and see which one would make a better investment.

WestRock – (WRK)

Market Cap: $8.85B

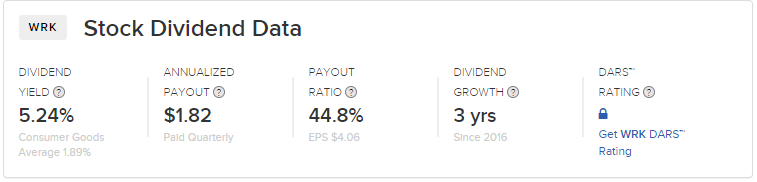

Dividend: $1.82

Dividend Yield: 5.25%

PE Ratio: 11.94

Price: $34.65

Given how beaten down the share price is WestRock looks very attractive from a value and income perspective.

International Paper – (IP)

Market Cap: $16.93B

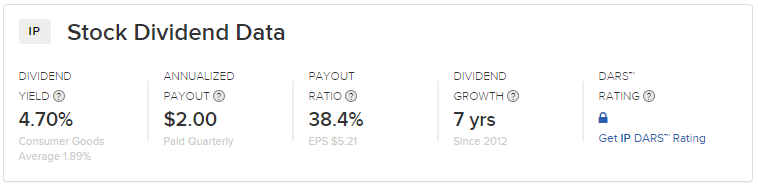

Dividend: $2.00

Dividend Yield: 4.69%

PE Ratio: 10.19

Price: $42.66

Container & Packaging Industry

All companies that operate in the container and packaging industry have felt the effects of the pricing of wood pulp for most of 2019, as this graph will show.

There is a direct correlation between high inventories and the lower pricing of the wood pulp itself. This is a factor that none of the companies operating in this industry can control but it is a factor that they all must deal with. As recently as June 24th, analysts like Goldman Sachs have downgraded stocks within the industry because of this factor.

Dividend Growth & Payout Ratio

Neither company has a long history of growing their dividend but both companies have very low payout ratios. In theory a company with a low payout ratio should have no problem not only sustaining their dividend but being able to increase it over time.

I do think that it is worth noting here that WestRock has only officially been a company since 2015. So they have actually increased their dividend since inception and have grown their dividend by a total of 21% but unfortunately that was just 3 years ago. International Paper on the other hand paid a steady dividend through out the 90’s and into the 2000’s but when the financial crisis happened in 2008 they cut their dividend the following year. Since then they have began the practise of increasing their dividend every year but their streak has only been running for 7 consecutive years.

Despite the fact that International Paper has been growing their dividend longer I tend to favor WestRock here. In just a couple of short years, I could see WestRock growing their dividend larger than International Paper. Recent acquisitions may hinder that in the short term but one the synergies really set in they will be generating more on the bottom line and can sustain growing their dividend larger.

Earnings Per Share

WestRock currently has an EPS of $2.90 with an estimated EPS of $4.03 for next year while currently having 255.50M shares outstanding.

International Paper currently has an EPS of $4.19 with an estimated EPS of $4.98 for next year while currently having 396.97M shares outstanding.

Looking at these figures I actually like the WestRock EPS better than I do the International Paper. Plus they stand to grow their EPS more than International Paper which will only help the company return capital to their shareholders.

Conclusion

Both companies stand to gain in the growing trend of ecommerce sales because most of those sales all will have to be shipped in a corrugated package. Plus as the growing population moves away from plastic products they will look more toward paper alternatives.

I honestly think at these prices you could buy stock in either company and do very well over the long term. Given the EPS, dividend and current valuation though I think that WestRock would be a better purchase at the moment. Despite carrying a heavy load of debt, I think that they are really setting themselves up for a very bright future with a lot of growth ahead of them.

Do you currently own stock in either company?

Which company do you think is the better purchase at these prices?

Just let me know in the comments below!

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Its a tough call as ratios are close so diving into minor details;

looking at the company’s debt WRK is slightly less leveraged so another edge there. IP’s 2018 financials show cash on hand went from $1B down to $500M, looking at their annual report it appears the $500M difference went to retiring debt and closing the gap between the two companies.

Running through the risks IP does have a pension funding risk that can drag $20-40M a year while WRK is over-funded. A risk for WRK is that they are reliant on some very large customers but hopefully acquisitions can help expand their customers.

I realize these are small factors but was looking for something to separate the two further. Overall I agree with you that WRK has a slight edge.

These are very good points. With WRK acquiring so much over the past few years, their debt load is something that I have kept a watch on!

Another that I will add in favor of WRK is that a lot of their converting facilities have been transitioning into new higher margin businesses. Some of that new business has been with new customers but some has been with some of the older customers.

Thanks for stopping by Ken. I look forward to talking with you more in the future!

Thank you for providing the statistics!