More Dividends Update from September 2020

September was an amazing month for me. The More Dividends portfolio absolutely killed it on the amount of dividend income received. A new record of $165 earned during one month!!! It may not seem like much but I am proud of it.

I can remember when I received my first dividend payment for $5, I felt like I had accomplished something. I still get the same feeling today when I get paid a dividend. I just get a lot more pulses of that feeling these days. As the income gets bigger it just helps me build this dividend snowball that much more.

I found several opportunities during the month to add to some existing positions in my portfolio. I was able to strengthen the positions in some dividend paying stocks as well as beginning to move small amounts of money into a muni bond fund.

Every bit of money that can be invested to the portfolio is only going to help me reach financial independence that much sooner!!!

Let’s take a look at how the portfolio has performed during the month of September!

Stock Additions

As stated in the introduction, I was able to find several good opportunities for the portfolio. I have been pretty content with strengthening existing positions. As you may have noticed most of the purchases I have been making this year have just been building onto existing positions. I am not against starting some new positions but I love the compounding ability of large positions.

Let’s have a look at which companies looked the most intriguing to me during September.

Store Capital (STOR) – 13 shares

AT&T (T) – 10 shares

iShares National Muni Bond ETF (MUB) – 1 shares

For me, I have had my eye on Store Capital since the beginning of the year when their stock price took a big hit. I have been very cautious up this point but with the company announcing 88% of their rent collected for the previous month I was inclined to purchase some stock here. I think their is some up side potential so I wanted to get in before the stock price took off.

I also like the future earning potential of AT&T. They have been paying down debt will still maintaining a healthy dividend. Plus I see the potential of them selling off DirectTV as a good thing for the company. That will allow them to pay down some more debt and to potential give a better dividend increase!

On top of these purchases, I have decided to begin funneling money into a muni bond fund. It doesn’t seem beneficial to me to keep money in a high interest savings account anymore. I would rather get a better return on my money by putting it in the muni bond fund until I decided to deploy the capital into good company stock.

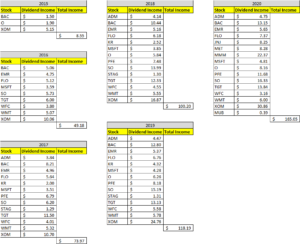

Dividends Received

It wasn’t quite a record month but it was still a great month. The dividends received is continuously being strengthen through the use of dividend reinvestment. Plus some of the new additions will make an impact on my 3rd month of the quarter.

Let’s have a look at what companies paid me a dividend this month.

Archer Daniel Midland (ADM) – $4.75 – Reinvested

Bank of America (BAC) – $13.15 – Reinvested

Emerson Electric (EMR) – $5.65 – Reinvested

Flowers Foods (FLO) – $7.37 – Reinvested

Johnson & Johnson (JNJ) – $8.25 – Reinvested

MetLife (MET) – $8.28 – Reinvested

3M (MMM) – $22.37 – Reinvested

Microsoft (MSFT) – $4.81 – Reinvested

Realty Income (O) – $8.16 – Reinvested

Pfizer (PF) – $11.68 – Reinvested

Southern Company (SO) – $16.33 – Reinvested

Target (TGT) – $13.84 – Reinvested

Wells Fargo (WFC) – $3.16 – Reinvested

Walmart (WMT) – $6.00 – Reinvested

Exxon Mobil (XOM) – $30.86 – Reinvested

iShares National Muni Bond ETF (MUB) – $00.39 – Reinvested

September was the last month of Q3 and accounted for $165.05 of my 2020 Dividend Income.

In total during 2020, I earned $ $991.19 in dividend income!

So far my dividends received looks like this

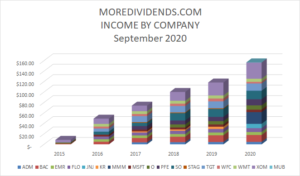

Dividends Received By Year

What a great month when I am able to produce 40% growth in the dividend income. Some of this growth is created by reinvesting the dividends but the bulk of this was produced by adding new capital to the portfolio. The bigger positions will help that dividend income total increase more and more!

I can’t wait to see the compounding really take off and those reinvested dividends create large amounts of growth as well.

Until then, let’s take a few looks at some different ways to analyse my monthly dividend income received during the month of September!

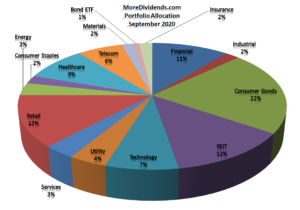

Portfolio Allocation

Some small shifts in the portfolio allocation were caused because of the recent stock additions. The Telecom sector went up 2% and the REIT sector saw a 1% increase. Other small shifts may have been caused by fluctuations in the market.

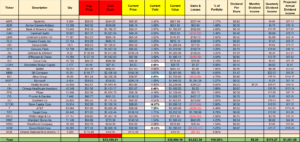

Current Portfolio

The portfolio is doing great. Even during low times in the market, my portfolio seems to be strong enough to still perform good. It is well diversified and continuing to grow all the time. I am enjoying were the portfolio is at right now and can only foresee good things in the future!

MoreDividends.com Articles

Here are the 5 articles that I posted on MoreDividends.com during September from oldest to newest.

More Dividends Update from August 2020

Store Capital Increases Their Dividend by 2.9% in 2020

Microsoft Increases Their Dividend by 9.8% in 2020

General Mills Increases Their Dividend by 4.1% in 2020

How Covid Has Shown Me All Of The Benefits Of Curbside Pickup!

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Killing it! The longer I do this dividend investing the more fun that I am having with it. I have never put in more money than what I am prepared to lose. With that being said I still strongly agree with Warren Buffetts rule that says to never lose money!

The income stream is steadily getting larger. I am able to to start to see those reinvestments really affect my portfolio. The snow ball is slowly getting bigger.

Despite, already maxing out my RothIRA for the year, I will continue to feed more capital into the portfolio. The only difference will be that it will not be held in a tax advantaged account.

Even though it will cause me to incur more taxes, I am ok because it will still be adding to the principle of the portfolio.

September was a great month for me and I am excited to see what the future holds!

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Wow, you got paychecks from 16 different companies in one month. That is pretty cool, keep it up and can’t wait to see even better returns in your future.

Great month. You are killing it already more than last year it looks like. And next month you hit a nice milestone it looks like. Just keep adding and you will see it grow.

Doug recently posted…September Dividend Review

Keep on crushing it MD. I’m so pumped that you are having a blast dividend investing. Keep up the great work and continue crushing it. Excellent, excellent stuff as always.

Bert

How good is dividend investing. Especially great when the companies raise their dividends each year. It’s like a free pay-rise for not having to do anything.

I’m a bit late to this update, but I was also able to pick up T in the last few months. I think it’s definitely got some room to move upwards, and I don’t mind earning 7.5% while it does. But unfortunately I missed out on STOR. That’s one that i’ll likely pickup if it does ever drop below the $27 mark again.

Do you always reinvest back into the same stock, or do you use the dividends received to relocate into other stocks in your profile?

Matt

Matt | thewahman recently posted…How to Optimize Free Consultations for Maximum ROI

I always reinvest!