More Dividends Update from February 2022

The month of February gave me plenty of reasons to celebrate. To start with, I was able to celebrate my 37th trip around the sun. Plus I was able to take a nice weekend trip with the girlfriend up to Mammoth Cave Kentucky. We are both on a quest to visit all of the National Parks. So with this trip we were both able to mark another one off of the list.

It didn’t take long after the trip to Kentucky for me to start planning for our next trip!

While I have been out there enjoying the adventure of life, it is nice to know that my portfolio has been holding down the fort.

February continues to be my highest paid 2nd month of the quarter.

Since my last report from January, I have begun purchasing stocks again. This time I decided to start some new positions while I continue to work to reallocate new capital.

Now, here is playing for legacy.

Let’s take a look at how well the portfolio performed last month.

Stock Purchases

Since my last monthly update, I have started 2 new positions.

The first one is in BP. Exxon Mobil was my only position in the energy sector up until now. BPs stock price has been knocked down a lot lately and I thought that now would present a good entry point for me to dollar cost average into the position.

Then, I also began a position in Verizon Communications. AT&T was my only position in this industry until now. Verizon has a great future ahead of them and they are definitely top of their industry.

Dividends Received

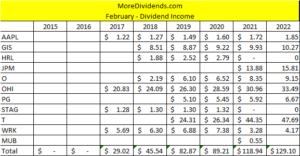

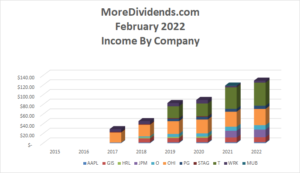

As mentioned, February is the 2nd month of the quarter so generally I would not expect it to be one of the highest paying months. Despite a slow start, the dividend income amount has seen a lot of growth over the past couple of years.

It will be very interesting in the years to come to see if February becomes one of largest dividend paying months.

Let’s take a look at those companies!

Apple (APPL) – $1.85 – Reinvested

General Mills (GIS) – $10.27 – Reinvested

JPMorgan Chase (JPM) – $15.81 – Reinvested

Realty Income (O) – $9.15 – Reinvested

Omega Healthcare Investors (OHI) – $33.49 – Reinvested

Procter & Gamble (PG) – $6.67 – Reinvested

AT&T (T) – $47.69 – Reinvested

WestRock (WRK) – $4.17 – Reinvested

February was the second month of Q1 and accounted for $129.10 of my 2022 Dividend Income.

In total as of February during 2022, I earned $225.43 in dividend income!

Dividends Received By Year

Year over year there has been a 8.5% increase in the amount of dividend income received during the month of February. This growth has all been powered by compounding growth! It will be intriguing to see how the growth continues in the future.

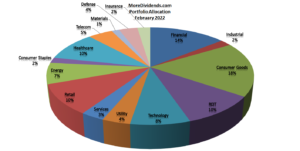

Portfolio Allocation

With the new purchases they did slightly impact thee allocation but not very much. The larger impact will be seen as I grow these positions.

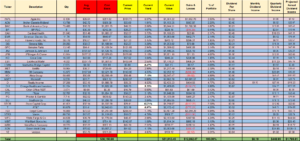

Current Portfolio

I have added in the new stock purchases and reinvested dividends. So I am very excited with the work that my portfolio has been performing but I am even more excited to begin putting fresh capital to work.

MoreDividends.com Articles

Here are the 5 articles that I posted on MoreDividends.com since the last monthly update from oldest to newest.

More Dividends Update from January 2022

3M Increases Their Dividend by 0.7% in 2022 !!!

Genuine Parts Increases Their Dividend by 10% in 2022 !!!

Coca Cola Increases Their Dividend by 4.8% in 2022 !!!

Walmart Increases Their Dividend by 2% in 2022 !!!

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

It was a great month. I was able to do some of the things that I enjoy most in life like hiking and traveling. While I was off playing my portfolio was still hard at work for me. Slowly collecting those dividends and reinvesting them.

It feels good to be buying stock again. A couple of new additions plus a few tricks to come.

As always I look forward to reading all of your comments and questions, until then….. happy investing!

Be sure and follow me on your favorite social media platform:

Facebook: MoreDividendsdotcom

Twitter @MoreDividends

Instagram adventurous.md

If you would like to receive an email whenever I publish a new article:

Solid dividend results. Nice to see we share a handful of names paying us both last month. Keep up the good work and reinvestment.

DivHut recently posted…Recent Stock Purchase March 2022