More Dividends Update from February 2020

February turned out to be an amazing month. If for no other reason, just the simple fact that I was blessed to be able to celebrate one more trip around the sun. That officially makes 35 trips around the sun for me!

I was able to to continue growing my dividend income which is splendid considering how small the second month of the quarter use to be for me. With the volatility that was created toward the end of the month I was even able to strengthen several of my existing positions in the portfolio.

A lot of work has been going into producing some new features here on the blog. I want to continue to grow this blog not only as a record of my investing journey but I want it to also be a place where people can learn fundamentals as well as develop their investing knowledge as they progress on their own investing journey.

In the coming weeks, I want to release some more spreadsheets related to investing and finance. I am also planning for some other new products to be released. I am super excited to start releasing some of these projects so that I can start getting some feedback from you the readers. As a matter of fact, I just decided the first 3 readers who comment on this post and say they want to check out the spreadsheets will get copies of them before they are released here on the blog.

Anyways, let’s go ahead and get this monthly update started and see how my portfolio was during the month of February.

Stock Additions

My question is who wasn’t putting more money to work with all of the volatility that we experienced at the end of February. Even still into March it looks like the market is trying to stabilize some but with this Coronavirus scare still going on I think there will be plenty of more buying opportunities in the near future.

My portfolio is already holding 30 positions so I am really looking to strengthen the positions that I have compared to creating new positions. So let’s see which positions that I added to during February.

JPMorgan Chase (JPM) – 2 shares

3M Company (MMM) – 5 shares

Pfizer (PFE) – 7 shares

Wells Fargo (WFC) – 5 shares

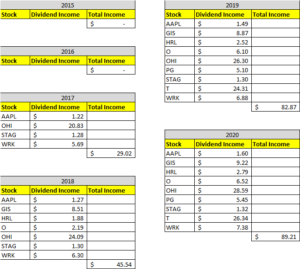

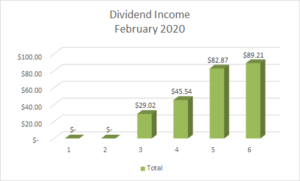

Dividends Received

As I mentioned in the introduction, the second month of the quarter has really taken off over the past 2 years. If you remember my article When Do I Want My Dividends Paid?”, then you will know that I don’t really pay attention to when my dividends are paid.

I am still very early in my investing career so I am more interested in just accumulating more shares than I am with trying to live off of the dividends. Despite this the second month of the quarter has gown at a very fast rate and I am excited to see how much more it can grow! Let’s take a look at all of the dividends that were received this month.

Apple (APPL) – $1.60 – Reinvested

General Mills (GIS) – $9.22 – Reinvested

Hormel (HRL) – $2.79

Realty Income (O) – $6.52 – Reinvested

Omega Healthcare Investors (OHI) – $28.59 – Reinvested

Procter & Gamble (PG) – $5.45 – Reinvested

STAG Industrial (STAG) – $1.32

AT&T (T) – $26.34 – Reinvested

WestRock (WRK) – $7.38 – Reinvested

February was the second month of Q1 and accounted for $89.21 of my 2020 Dividend Income.

In total during 2020, I have earned $155.89 in dividend income!

So far my dividends received looks like this

Dividends Received By Year

Year over year, I saw a 7.7% increase in dividend income. All of this growth was created through increasing and reinvesting dividends. I have some great companiies that pay me dividends during this month and I would love to be able to add to them if their share price reaches down close to ym cost basis.

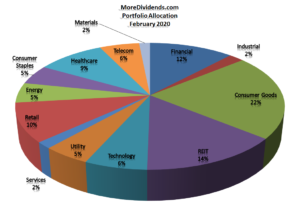

Portfolio Allocation

Additions and market fluctuations created some changes in my portfolio allocation. The new shares of 3M pushed the Consumer Goods sector up to 22% from 20%. Plus with the drop in share price for Exxon Mobil it took my allocation in the energy sector down from 6% to 5%. Despite these changes in my portfolio allocation I am still feeling very comfortable with it. I will keep an eye on the Consumer Goods sector because I don’t want it to g7et much larger than it is right now.

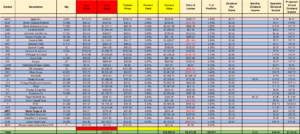

Current Portfolio

I absolutely love to see what my portfolio is becoming. I do not pay attention too much to the current value, what I am excited about is the share counts. Once the market turns more bullish again the share counts will only push the value that much higher.

Even my positions that are showing in the red…. they are not truly a loss until I sell. Since I am a long term investor I have no intentions of selling any time soon. So when I see a position in the red that just lets me know that I will be reinvesting dividends are bargain prices!

MoreDividends.com Articles

Here are the 7 articles that I posted on MoreDividends.com during February from oldest to newest.

3M Increased Their Dividend By 2%

More Dividends Update from January 2020

Review of the Simply Investing Report

How to Pay off Debt to Buy a House

JUST ANNOUNCED: Walmart Increases Their Dividend by 1.9%

JUST ANNOUNCED: Genuine Parts Increases Their Dividend by 3.6%

Coca Cola Increases Their Dividend by 2.5%

If you are interested in posting a guest post, just head over to the Contact Page and send me a message.

Conclusion

Wouldn’t you agree that February was a great month. I mean I did manage to be blessed with one more year on this earth.

Plus I was able to build onto existing positions in the portfolio which will continue to pay off in dividends for years to come. Pun was intended! Had a great month with dividends received.

One thing that I haven’t mentioned is that all of my metrics for the blog were in the green at the end of the month despite the fact that February is the shortest month of the year. I would love to see that trend continue as I work to add more value to this blog for you the readers. If you have any thoughts of something that you would like to see here I would love to hear about it down in the comments.

Now as we move into the last month of the quarter, I am hoping to be able to put together another great month. Only time will tell if I will be successful at that but regardless you will be able to hear all about the month of March in the next edition of the monthly update!

As always I look forward to reading all of your comments and questions, until then….. happy investing!

-Jason from MoreDividends.com

Be sure and follow me on your favorite social media platform:

MoreDividendsdotcom on Facebook & @MoreDividends on Twitter

If you would like to receive an email whenever I publish a new article:

Good add on MMM,i was also looking WFC,i am getting close t0 full position ,so still thinking.

Thank you desidividend. MMM is a new position for me so I am glad that I got a chance to add some so early on. WFC I have been sitting on for a couple of years but it seemed like a good time to add some. If they don’t improve their revenue we may have more opportunities to increase our positions in the near future!

Nice job collecting those dividends. Like the PFE pick up too. Not sure what’s going to happen with their spin off plans this year considering the market environment.

DivHut recently posted…Dividend Income Update February 2020

Thanks DivHut. Great hearing from you. I hope that all has been going well 🙂